Question: Problem 24-31 (Algorithmic) (LO. 5) Dillman Corporation has nexus in State A and State B. Dillman's activities for the year are summarized below: Total State

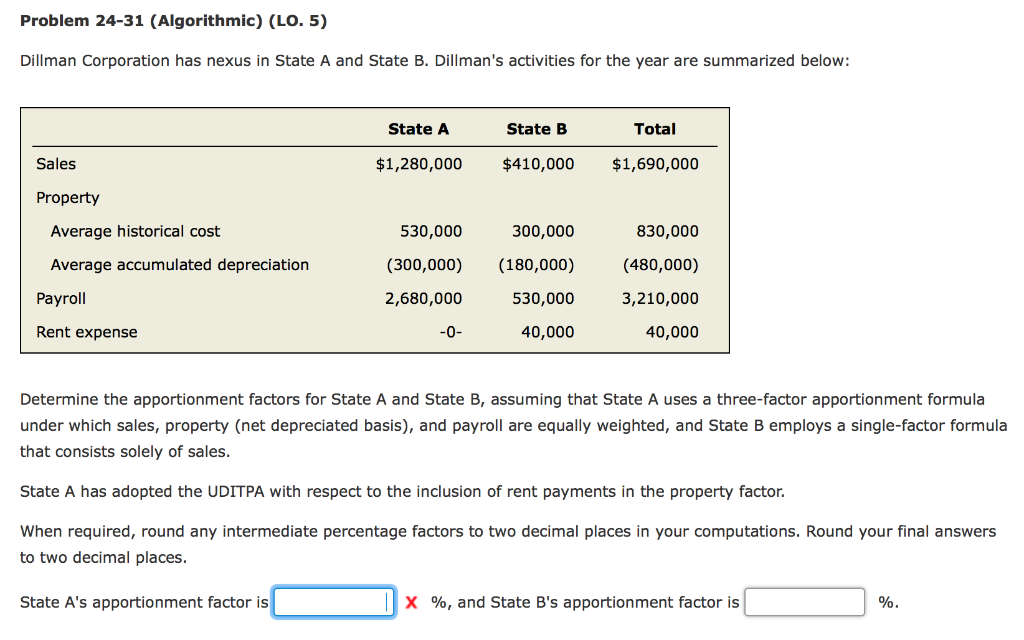

Problem 24-31 (Algorithmic) (LO. 5) Dillman Corporation has nexus in State A and State B. Dillman's activities for the year are summarized below: Total State A State B Sales $1,280,000 $410,000 $1,690,000 Property 530,000 830,000 (480,000) 3,210,000 40,000 Average historical cost 300,000 (300,000) (180,000) 530,000 40,000 Average accumulated depreciation Payroll 2,680,000 Rent expense Determine the apportionment factors for State A and State B, assuming that State A uses a three-factor apportionment formula under which sales, property (net depreciated basis), and payroll are equally weighted, and State B employs a single-factor formula that consists solely of sales State A has adopted the UDITPA with respect to the inclusion of rent payments in the property factor. When required, round any intermediate percentage factors to two decimal places in your computations. Round your final answers to two decimal places State A's apportionment factor is X %, and State B's apportionment factor is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts