Question: Problem 2-5A (Static) Computing and applying overhead to jobs; recording under-or overapplied overhead LO P3, P4 At the beginning of the year, Learer Company's manager

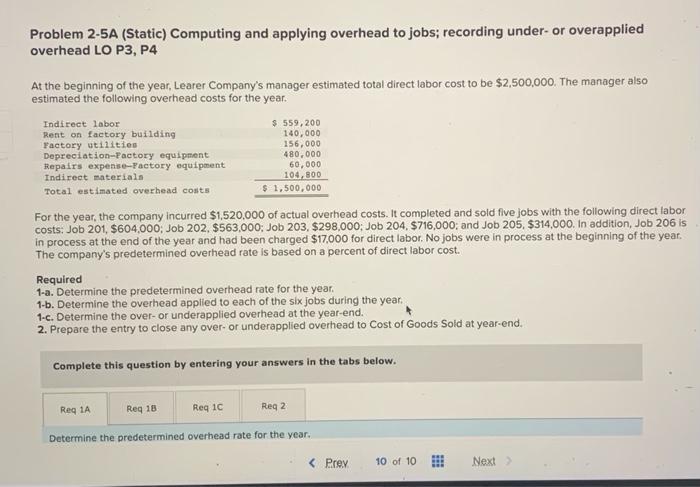

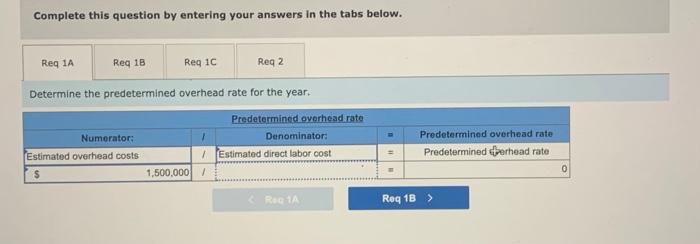

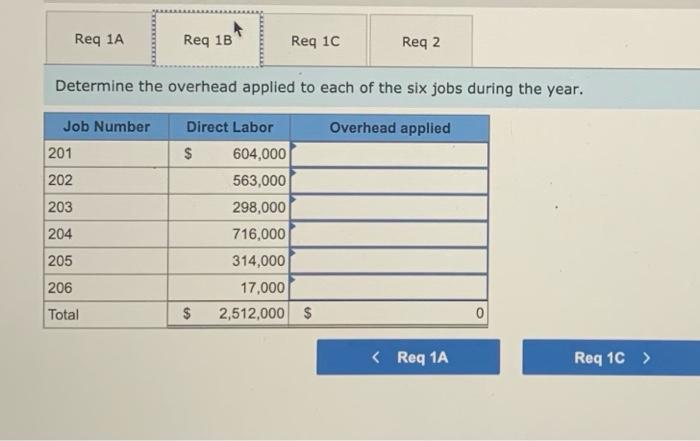

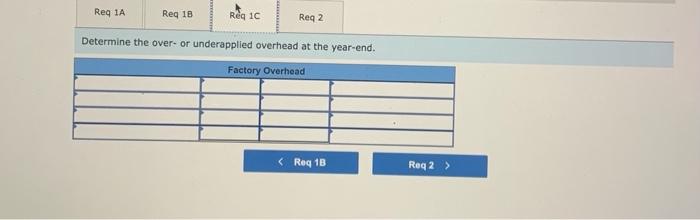

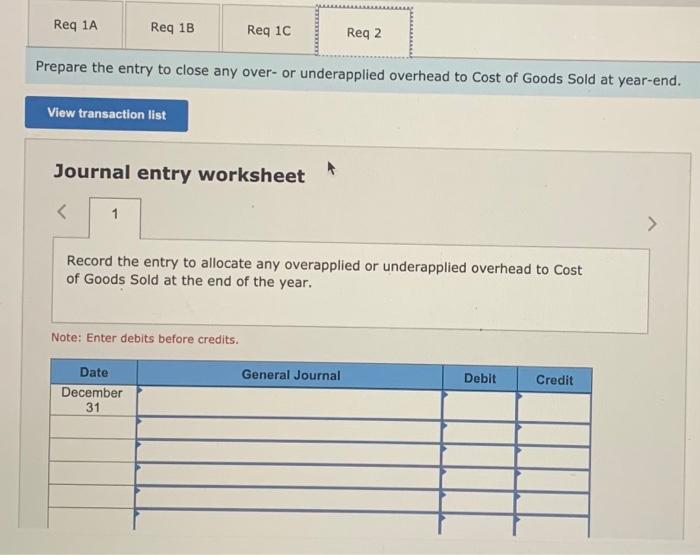

Problem 2-5A (Static) Computing and applying overhead to jobs; recording under-or overapplied overhead LO P3, P4 At the beginning of the year, Learer Company's manager estimated total direct labor cost to be $2,500,000. The manager also estimated the following overhead costs for the year. Indirect labor $ 559,200 Rent on factory building 140,000 Factory utilities 156,000 Depreciation-Factory equipment 480.000 Repairs expense-Factory equipment 60,000 Indirect materials 104,800 Total estimated overhead costs $ 1,500,000 For the year, the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, $604,000, Job 202, $563,000; Job 203, $298,000; Job 204, $716,000; and Job 205, $314,000. In addition, Job 206 is in process at the end of the year and had been charged $17,000 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on a percent of direct labor cost. Required 1-a. Determine the predetermined overhead rate for the year. 1-b. Determine the overhead applied to each of the six jobs during the year. 1-c. Determine the over- or underapplied overhead at the year-end. 2. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. Complete this question by entering your answers in the tabs below. Req 1A Req 18 Reg 10 Reg 2 Determine the predetermined overhead rate for the year. Req 1A Req 1B Req 10 Req 2 Determine the overhead applied to each of the six jobs during the year. Job Number 201 Overhead applied 202 203 Direct Labor $ 604,000 563,000 298,000 716,000 314,000 17,000 $ 2,512,000 $ 204 205 206 Total 0 Reg 1A Reg 18 Req 1C Req 2 Determine the over- or underapplied overhead at the year-end. Factory Overhead Reg 1B Req2 > Req 1A Reg 1B Req 1C Reg 2 Prepare the entry to close any over- or underapplied overhead to cost of Goods Sold at year-end. View transaction list Journal entry worksheet Record the entry to allocate any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. Note: Enter debits before credits. General Journal Debit Credit Date December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts