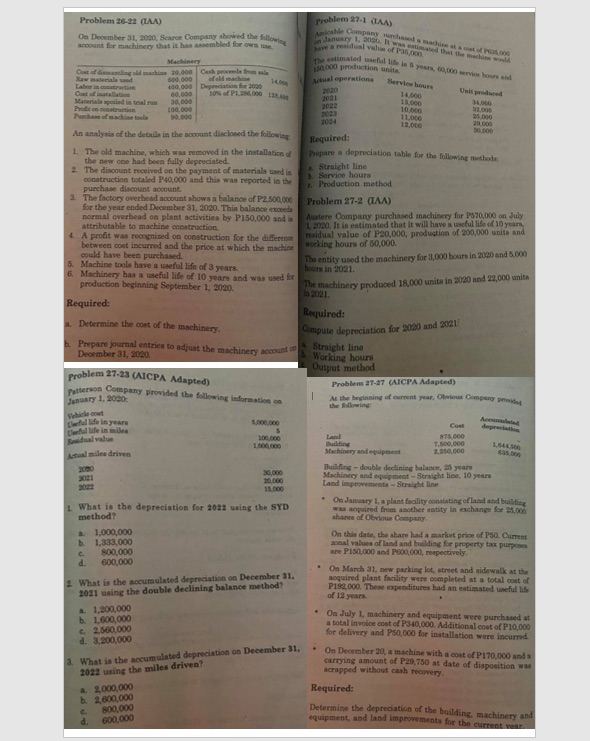

Question: Problem 26-12 (LAA) Problem 27-1 (LAA) On December 31. 4140, Scarce Company showed the fallost account for machinery that it has awembled for owe me.

Problem 26-12 (LAA) Problem 27-1 (LAA) On December 31. 4140, Scarce Company showed the fallost account for machinery that it has awembled for owe me. amicable Company purchased a machine at a meal of PEASOUP January 1. Bogue It was estimated that the machine wools have a residual value of Pas,oog, Mackin Cash proceeds from uh The retimated usntial life is A pears, 60,000 service lepers srel goooo production unita, Actual operations Depreciation for 1090 Service hours Labor in cocatroutine 60.900 10N PL350030 138,AM 14.600 Unit produced Material ipound in trial ria Prodbon pourtruction 24 080 40.600 An unilyeds of the details in the account disclosed the billowing Required: 1 The old machine, which was removed in the installation of Prepare a depreciation table for the following methods the new one had been fully depreciated. 2. The discount received on the payment of materials used in Straight line construction totaled P40,000 and this was reported in the Service hours Production method purchase discount account The factory overhead account shows a balance of P2,500,000 Problem 27-2 (LAA) for the year ended December 31. 2020. Thin balance exceeds normal overhead on plant activities by P150,000 and a Watere Company purchased machinery for P570,000 on July attributable to machine coratruction. Soed It in estimated that it will have a useful life of 10 years, 4. A profit was recognized on construction for the difference realdual value of P20,000, production of 200,000 units and between cost incurred and the price at which the machine working hours of 50,000. could have been purchased. The entity used the machinery for 3,090 hours in 2020 and 5,000 Machine tools have a useful life of 3 years. hours in 2021. Machinery has a useful life of 10 years and was used for production beginning September 1, 2020. The machinery produced 18,000 units in 2020 and 22,000 units In 202 1. Required: Required: a. Determine the cost of the machinery. Compute depreciation for 2020 and 2021 Prepare journal entries to adjust the machinery account of Straight line December 31, 2020. Working hours Output method problem 27-23 (AICPA Adapted) Problem 27-27 (AICPA Adapted) patterson Company provided the following information on January 1, 2020: At the beginning of current par, Obvious Company provided Held Efe in years Cost depreciation Wheeled life in miles 1.140.000 Actual Len driven Machinery and epiput Building - double declining balance, 2 years Machinery and equipment - Straight hex, 10 year Land improvem ante - Straight line On January 1, a plant facility consisting of land and building L What is the depreciation for 1021 using the SYD whil acquired from amother sutity in exchange for 13,090 method? ibane of Obvious Company 1,000,000 On this date, the share had a market price of Pad. Current 1.333,000 zonal values of land and building for property tax purpoon 800,000 are P150,000 and P600,000, respectively. 600.000 On March 31, new parking lot, street and sidewalk at the What is the accumulated depreciation on December $1. noquired plant facility were completed at a total cost of 2021 using the double declining balance method? P192,000. These expenditures had an estimated useful life of 19 years 1,200,000 On July 1, machinery and equipment were purchased at 1.6001000 a total invoice cost of P340,000. Additional cost of P10,000 2.560,000 for delivery and P50,000 for installation were incurred 3.200 000 What is the accumulated depreciation on December 31, . On December 20, a machine with a cost of P170,000 and a carrying amount of P29,750 at date of disposition was 2022 using the miles drivent scrapped without cash recovery. . 2,000,000 Required: b. 2.600,000 C. 600,000 Determine the depreciation of the building, machinery and 600 000 equipment, and land improvements for the curr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts