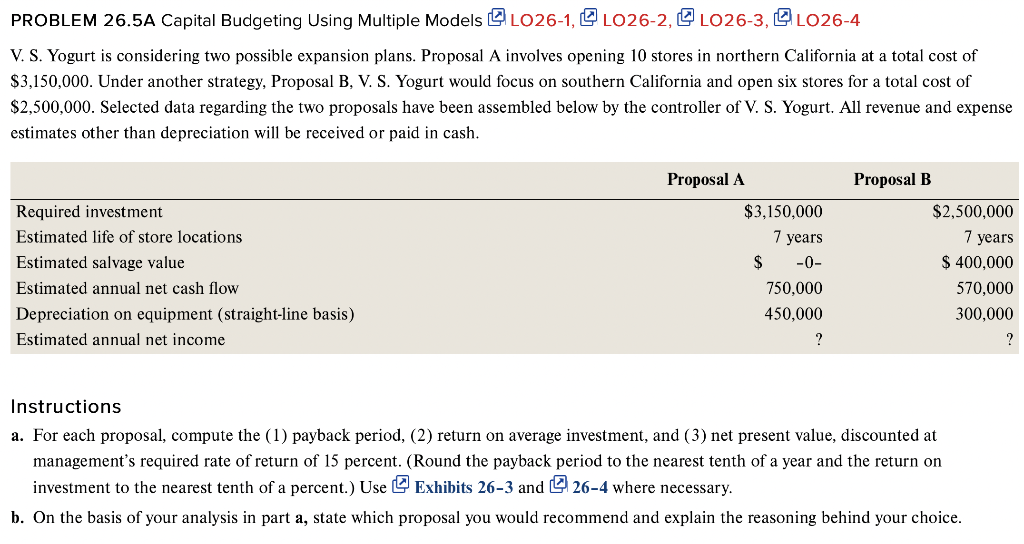

Question: PROBLEM 26.5A Capital Budgeting Using Multiple Models QL026-1, QL026-2, @L026-3, QL026-4 V. S. Yogurt is considering two possible expansion plans. Proposal A involves opening 10

PROBLEM 26.5A Capital Budgeting Using Multiple Models QL026-1, QL026-2, @L026-3, QL026-4 V. S. Yogurt is considering two possible expansion plans. Proposal A involves opening 10 stores in northern California at a total cost of $3,150,000. Under another strategy, Proposal B, V. S. Yogurt would focus on southern California and open six stores for a total cost of $2,500,000. Selected data regarding the two proposals have been assembled below by the controller of V. S. Yogurt. All revenue and expense estimates other than depreciation will be received or paid in cash. Proposal A Required investment Estimated life of store locations Estimated salvage value Estimated annual net cash flow Depreciation on equipment (straight-line basis) Estimated annual net income $3,150,000 7 years $ -O- 750,000 450,000 ? Proposal B $2,500,000 7 years $ 400,000 570,000 300,000 ? Instructions a. For each proposal, compute the (1) payback period, (2) return on average investment, and (3) net present value, discounted at nagement's required rate of return of 15 percent. (Round the payback period to the nearest tenth of a year and the return investment to the nearest tenth of a percent.) Use Exhibits 26-3 and 26-4 where necessary. b. On the basis of your analysis in part a, state which proposal you would recommend and explain the reasoning behind your choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts