Question: Problem 27-10 , 27-11 and 27-12. Problem 27-10 (AICPA Adapted) On January 1, 2020, Domino Company purchased a new machine for P4,000,000. The new machine

Problem 27-10 , 27-11 and 27-12.

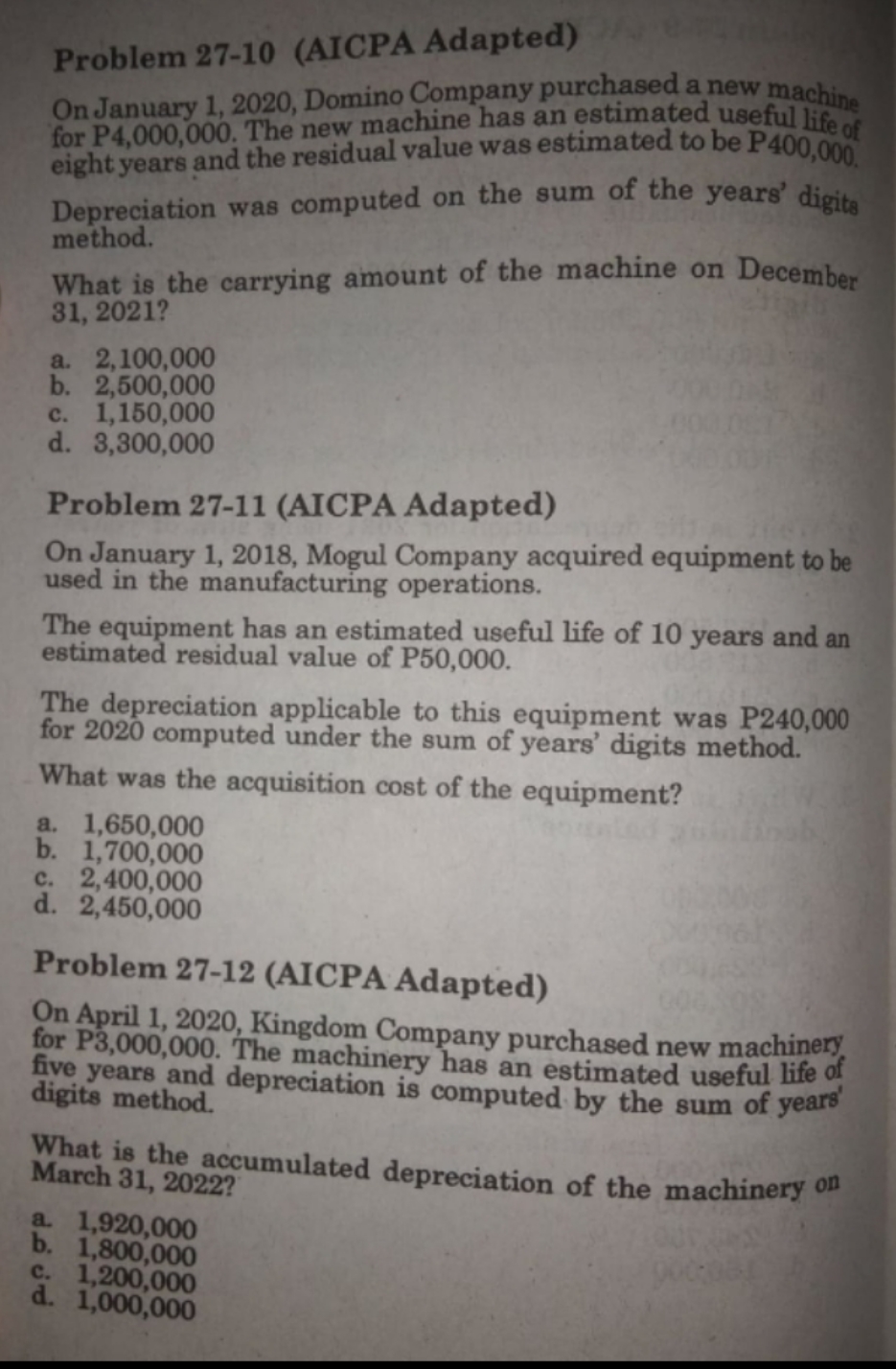

Problem 27-10 (AICPA Adapted) On January 1, 2020, Domino Company purchased a new machine for P4,000,000. The new machine has an estimated useful life of eight years and the residual value was estimated to be P400,000 Depreciation was computed on the sum of the years' digits method. What is the carrying amount of the machine on December 31, 2021? a. 2,100,000 b. 2,500,000 c. 1, 150,000 d. 3,300,000 Problem 27-11 (AICPA Adapted) On January 1, 2018, Mogul Company acquired equipment to be used in the manufacturing operations. The equipment has an estimated useful life of 10 years and an estimated residual value of P50,000. The depreciation applicable to this equipment was P240,000 for 2020 computed under the sum of years' digits method. What was the acquisition cost of the equipment? a. 1,650,000 b. 1,700,000 C. 2,400,000 d. 2,450,000 Problem 27-12 (AICPA Adapted) On April 1, 2020, Kingdom Company purchased new machinery for P3,000,000. The machinery has an estimated useful life of five years and depreciation is computed by the sum of years' digits method. What is the accumulated depreciation of the machinery on March 31, 2022? a. 1,920,000 b. 1,800,000 C. 1,200,000 d. 1,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts