Question: PROBLEM 27.3 An engineering company is conside- ring its working capital investment for the next year. Estimated fixed assets and current liabilities for the next

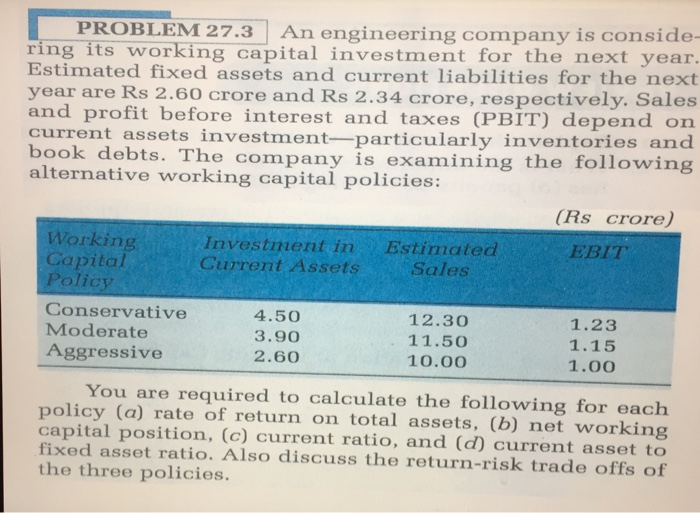

PROBLEM 27.3 An engineering company is conside- ring its working capital investment for the next year. Estimated fixed assets and current liabilities for the next year are Rs 2.60 crore and Rs 2.34 crore, respectively. Sales and profit before interest and taxes (PBIT) depend on current assets investment-particularly inventories and book debts. The company is examining the following alternative working capital policies: (Rs crore) Working Capital Policy Estimated Sales Investment in Current Assets EBIT Conservative Moderate Aggressive 4.50 12.30 1.23 3.90 11.50 10.00 1.15 2.60 1.00 You are required to calculate the following for each policy (a) rate of return on total assets, (b) net working capital position, (c) current ratio, and (d) current asset to fixed asset ratio. Also discuss the return-risk trade offs of the three policies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts