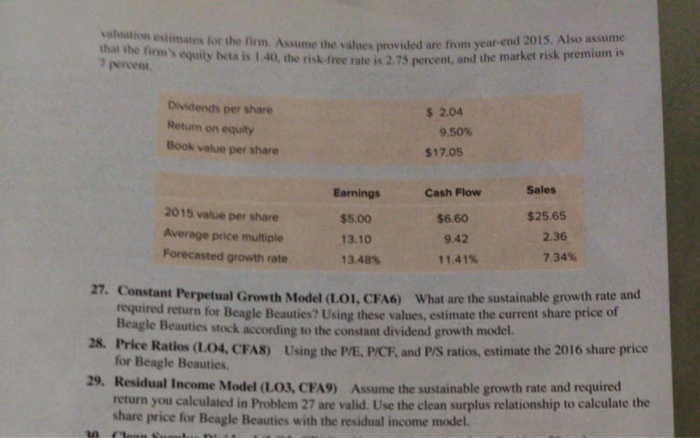

Question: problem 29 on estimates for the firm. Assume the values provided are from year Assume the values provided are from year-end 2015. Also assume that

on estimates for the firm. Assume the values provided are from year Assume the values provided are from year-end 2015. Also assume that the tim's equity betais 1.40 the rise free rate is 2.75 percent, and the Noent free rate is 2.75 percent, and the market risk premium is Dividends per share Return on equity Book value per share $ 2.04 9,50% $17.05 Cash Flow Sales 2015 value per share Average price multiple Forecasted growth rate Earnings $5.00 13.10 13.48% $6.60 9.42 11.41% $25.65 2.36 7.34% 27. Constant Perpetual Growth Mode LOL CRAWhat are the sustainable growth rate required return for Beagle Beauties? Using these values, estimate the current share price of Beagle Beauties stock accordine to the constant dividend growth model 28. Price Ratios (L04, CFAS) Using the P/E, P/CF, and P/S ratios, estimate the 2016 share price for Beagle Beauties 29. Residual income Model (LO3, CFA9) Assume the sustainable growth rate and rem return you calculated in Problem 27 are valid. Use the clean surplus relationship to calculate the share price for Beagle Beauties with the residual income model CS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts