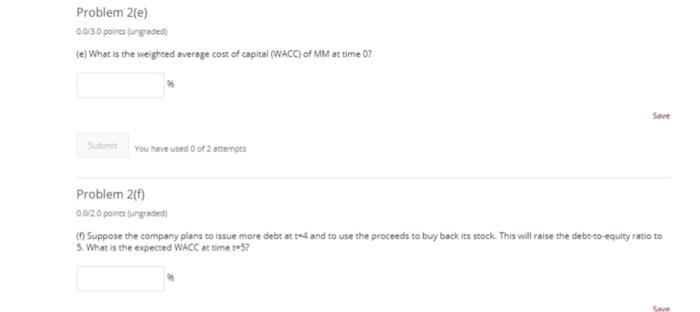

Question: Problem 2(e) 0.0/3.0 points (ungraded (e) What is the weighted average cost of capital (WACC) of MM at time 0? Save Subm You have used

Problem 2(e) 0.0/3.0 points (ungraded (e) What is the weighted average cost of capital (WACC) of MM at time 0? Save Subm You have used 0 of 2 attempts Problem 210 0.0/2.0 points (ungraded in Suppose the company plans to issue more debt atted and to use the proceeds to buy back its stock. This will raise the debt-to-equity ratio to 5. What is the expected WACC at time t-5? Cave Problem 21a) 00.3.0 points and Assume no se or other frictions. Master Minds (MM Inc. is expected to have a free cash flow of 558.0 million next year, which will subsequently grow at 20% a year forever. The cost of capital of Mis 10.0 per year. The risk free interest rates 60. In addition, it also has a perpetual console bond outstanding which pays $13.0 million per year, starting from next year. The band is free

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts