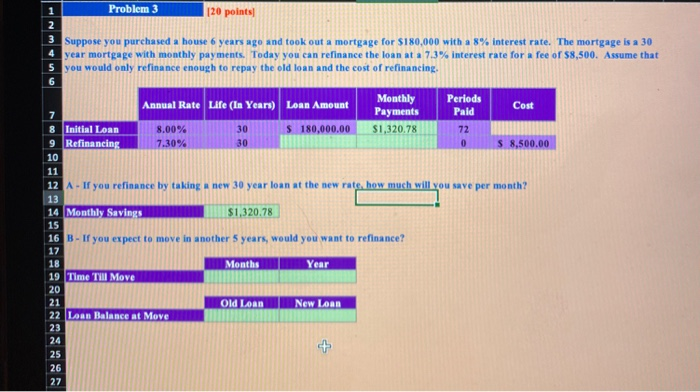

Question: Problem 3 1 2 120 points 0 3 Suppose you purchased a house 6 years ago and took out a mortgage for $180,000 with a

Problem 3 1 2 120 points 0 3 Suppose you purchased a house 6 years ago and took out a mortgage for $180,000 with a 8% interest rate. The mortgage is a 30 4 year mortgage with monthly payments. Today you can refinance the loan at a 7.3% interest rate for a fee of $8,500. Assume that 5 you would only refinance enough to repay the old loan and the cost of refinancing. 6 Annual Rate Life (In Years) Monthly Periods Loan Amount Cost 7 Payments Pald 8 Initial Loan 8.00% 30 $ 180,000.00 $1,320.78 72 9 Refinancing 7.30% 30 $ 8,500.00 10 11 12 - If you refinance by taking new 30 year loan at the new rate how much will you save per month? 13 14 Monthly Savings $1,320.78 15 16 B - If you expect to move in another 5 years, would you want to refinance? 17 18 Months Year 19 Time Til Move 20 21 Old Loan New Loan 22 Loan Balance at Move 23 24 25 26 27 + Problem 3 1 2 120 points 0 3 Suppose you purchased a house 6 years ago and took out a mortgage for $180,000 with a 8% interest rate. The mortgage is a 30 4 year mortgage with monthly payments. Today you can refinance the loan at a 7.3% interest rate for a fee of $8,500. Assume that 5 you would only refinance enough to repay the old loan and the cost of refinancing. 6 Annual Rate Life (In Years) Monthly Periods Loan Amount Cost 7 Payments Pald 8 Initial Loan 8.00% 30 $ 180,000.00 $1,320.78 72 9 Refinancing 7.30% 30 $ 8,500.00 10 11 12 - If you refinance by taking new 30 year loan at the new rate how much will you save per month? 13 14 Monthly Savings $1,320.78 15 16 B - If you expect to move in another 5 years, would you want to refinance? 17 18 Months Year 19 Time Til Move 20 21 Old Loan New Loan 22 Loan Balance at Move 23 24 25 26 27 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts