Question: Problem 3 (10 points) A stock process starts at time 0 at 100 and then can go 30 up or 10 down for each time

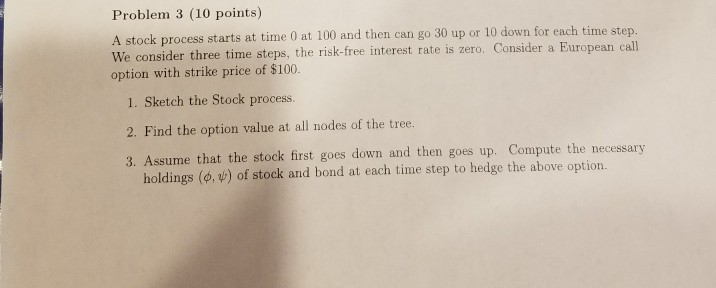

Problem 3 (10 points) A stock process starts at time 0 at 100 and then can go 30 up or 10 down for each time step. We consider three time steps, the risk-free interest rate is zero. Consider a European call option with strike price of $100. 1. Sketch the Stock process. 2. Find the option value at all nodes of the tree. 3. Assume that the stock first goes down and then goes up. Compute the necessary holdings (.) of stock and bond at each time step to hedge the above option. Problem 3 (10 points) A stock process starts at time 0 at 100 and then can go 30 up or 10 down for each time step. We consider three time steps, the risk-free interest rate is zero. Consider a European call option with strike price of $100. 1. Sketch the Stock process. 2. Find the option value at all nodes of the tree. 3. Assume that the stock first goes down and then goes up. Compute the necessary holdings (.) of stock and bond at each time step to hedge the above option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts