Question: Problem 3 (10 points) Consider a stock process that starts at time 0 at 100 and then can go up and down 20 for each

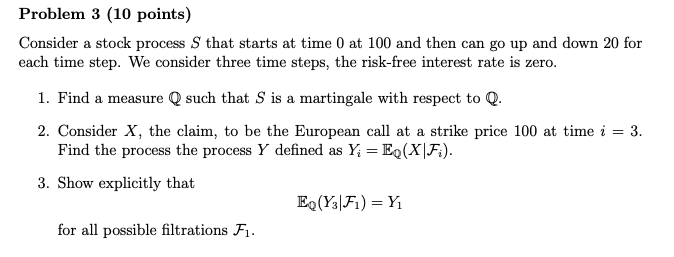

Problem 3 (10 points) Consider a stock process that starts at time 0 at 100 and then can go up and down 20 for each time step. We consider three time steps, the risk-free interest rate is zero. 1. Find a measure Q such that S is a martingale with respect to Q. 2. Consider X, the claim, to be the European call at a strike price 100 at time i = 3. Find the process the process Y defined as Y; = E (X|Fi). 3. Show explicitly that E (Y3|F1)=Y for all possible filtrations Fi. Problem 3 (10 points) Consider a stock process that starts at time 0 at 100 and then can go up and down 20 for each time step. We consider three time steps, the risk-free interest rate is zero. 1. Find a measure Q such that S is a martingale with respect to Q. 2. Consider X, the claim, to be the European call at a strike price 100 at time i = 3. Find the process the process Y defined as Y; = E (X|Fi). 3. Show explicitly that E (Y3|F1)=Y for all possible filtrations Fi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts