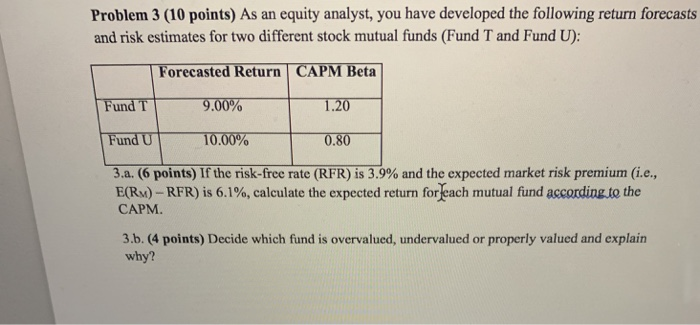

Question: Problem 3 (10 points) As an equity analyst, you have developed the following return forecasts and risk estimates for two different stock mutual funds (Fund

Problem 3 (10 points) As an equity analyst, you have developed the following return forecasts and risk estimates for two different stock mutual funds (Fund T and Fund U): Forecasted Return CAPM Beta Fund T 9.00% 1.20 Fund U 10.00% 0.80 3.a. (6 points) If the risk-free rate (RFR) is 3.9% and the expected market risk premium (i.e., E(RM) - RFR) is 6.1%, calculate the expected return for each mutual fund according to the . 3.b. (4 points) Decide which fund is overvalued, undervalued or properly valued and explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts