Question: Problem 3 (11 points) You are looking at a commodities futures and believe that you have identified an arbitrage opportunity. Of course, there must be

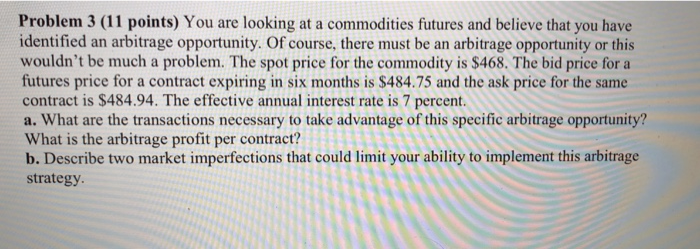

Problem 3 (11 points) You are looking at a commodities futures and believe that you have identified an arbitrage opportunity. Of course, there must be an arbitrage opportunity or this wouldn't be much a problem. The spot price for the commodity is $468. The bid price for a futures price for a contract expiring in six months is $484.75 and the ask price for the same contract is $484.94. The effective annual interest rate is 7 percent. a. What are the transactions necessary to take advantage of this specific arbitrage opportunity? What is the arbitrage profit per contract? b. Describe two market imperfections that could limit your ability to implement this arbitrage strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts