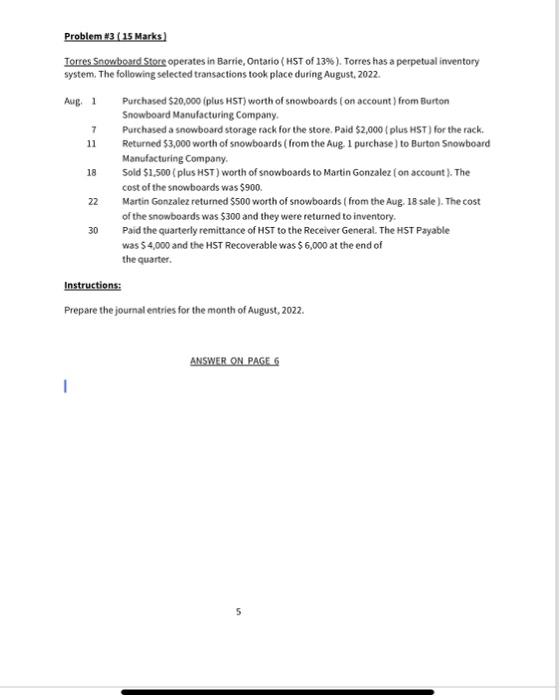

Question: Problem #3 ( 15 Marks) Terres Snowbeard Store operates in Barrie, Ontario ( HST of 13%). Torres has a perpetual inventory system. The following selected

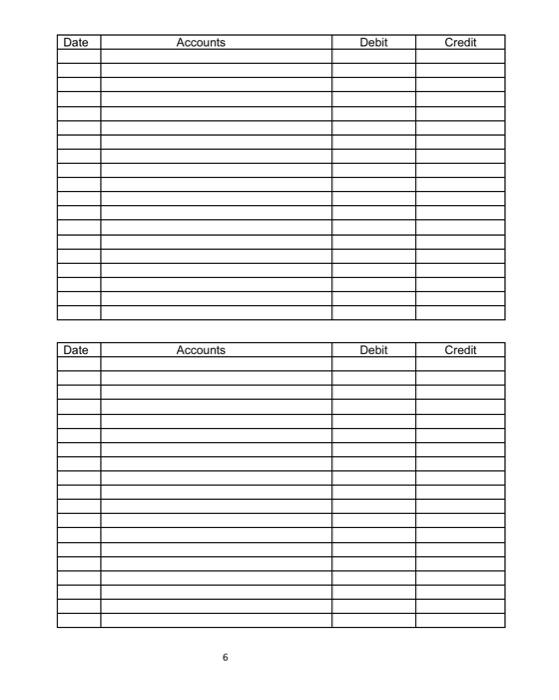

Problem #3 ( 15 Marks) Terres Snowbeard Store operates in Barrie, Ontario ( HST of 13\%). Torres has a perpetual inventory system. The following selected transactions took place during August, 2022. Aug. 1 Purchased $20,000 (plus HST) worth of snowboards (on account) from Burton Snowboard Manufacturing Company. 7 Purchased a snowboard storage rack for the store. Paid $2,000 ( plus HST) for the rack. 11 Returned $3,000 worth of snowboards ( from the Aug 1 purchase) to Burton 5 nowbeard Manufacturing Company. 18 Sold $1,500 (plus HST) worth of snowboards to Martin Gonzalez (on account ). The cost of the snowboards was $900. 22 Martin Gonzalez returned $500 worth of snowboards ( from the Aug. 18 sale). The cost of the snowboards was $300 and they were retumed to inventory. 30 Paid the quarterly remittance of HST to the Receiver General. The HST Payable was $4,000 and the HST Recoverable was $6,000 at the end of the quarter. Instructions: Prepare the journal entries for the month of August, 2022. \begin{tabular}{|l|l|l|l|} \hline Date & Accounts & Debit & Credit \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts