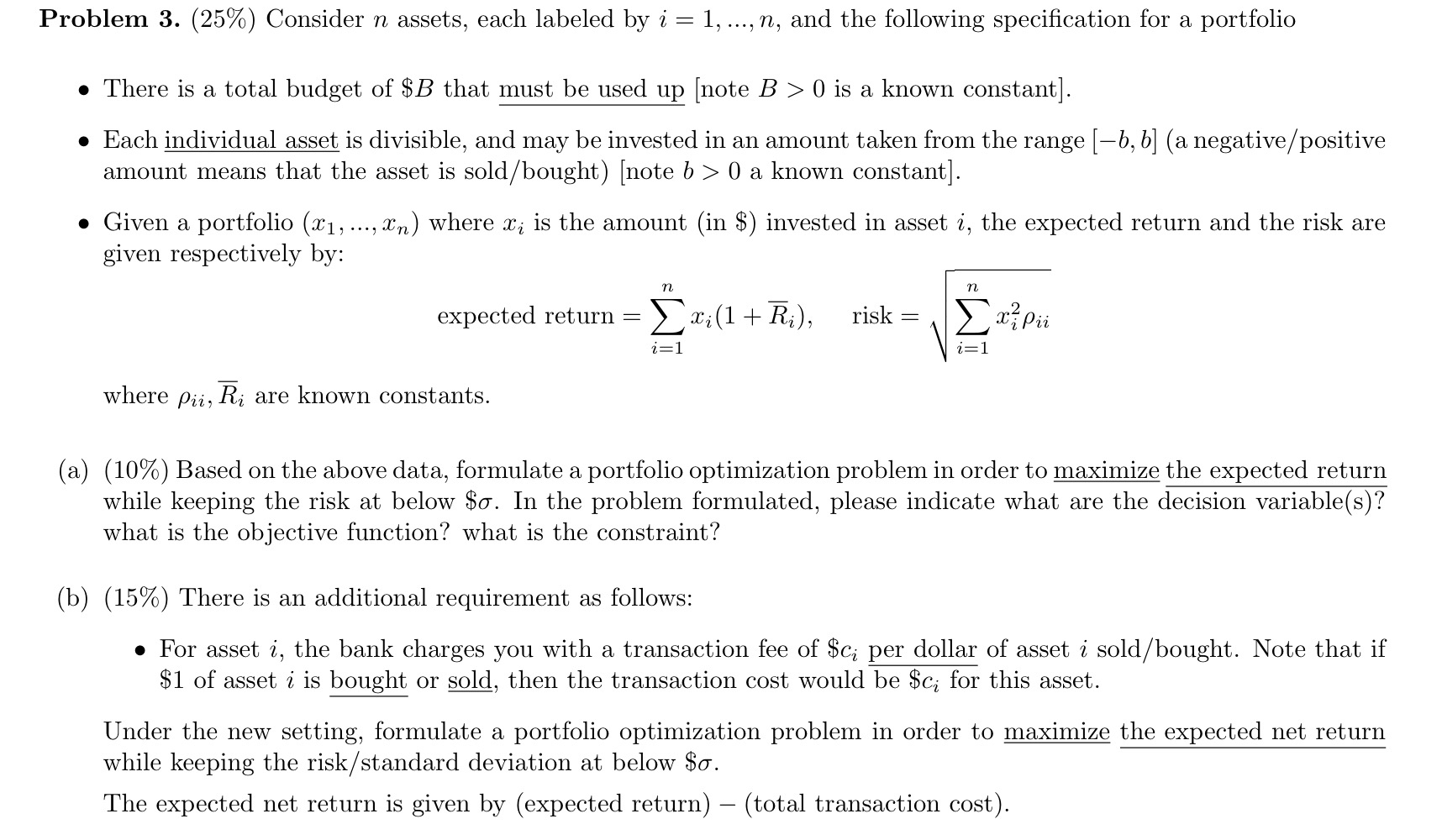

Question: Problem 3 . ( 2 5 % ) Consider n assets, each labeled by i = 1 , dots, n , and the following specification

Problem Consider assets, each labeled by dots, and the following specification for a portfolio

There is a total budget of $ that must be used up note is a known constant

Each individual asset is divisible, and may be invested in an amount taken from the range a negativepositive amount means that the asset is soldboughtnote a known constant

Given a portfolio dots, where is the amount in $ invested in asset the expected return and the risk are given respectively by:

expected return risk

where are known constants.

a Based on the above data, formulate a portfolio optimization problem in order to maximize the expected return while keeping the risk at below $ In the problem formulated, please indicate what are the decision variables what is the objective function? what is the constraint?

b There is an additional requirement as follows:

For asset the bank charges you with a transaction fee of $ per dollar of asset i soldbought Note that if $ of asset is bought or sold, then the transaction cost would be $ for this asset.

Under the new setting, formulate a portfolio optimization problem in order to maximize the expected net return while keeping the riskstandard deviation at below $

The expected net return is given by expected returntotal transaction cost

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock