Question: Problem 3 . ( 2 5 p ) ( i ) ( 5 p ) Recall that the Delta of the option measures the rate

Problem p

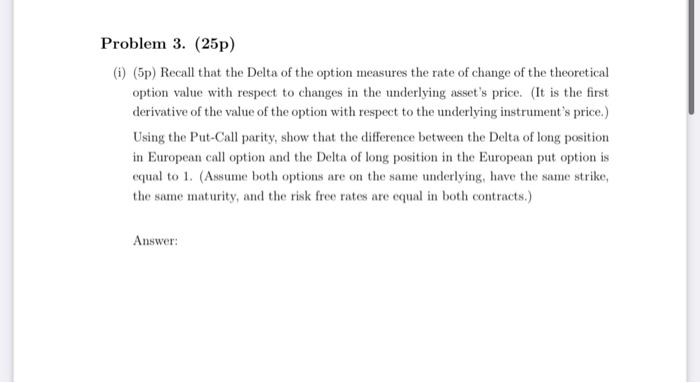

ip Recall that the Delta of the option measures the rate of change of the theoretical option value with respect to changes in the underlying asset's price. It is the first derivative of the value of the option with respect to the underlying instrument's price. Using the PutCall parity, show that the difference between the Delta of long position in European call option and the Delta of long position in the European put option is equal to Assume both options are on the same underlying, have the same strike, the same maturity, and the risk free rates are equal in both contracts.

Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock