Question: Problem 3: 20 marks Drills Limited is considering a new project that complements its existing business. The machine required for the projec costs $3.9 million.

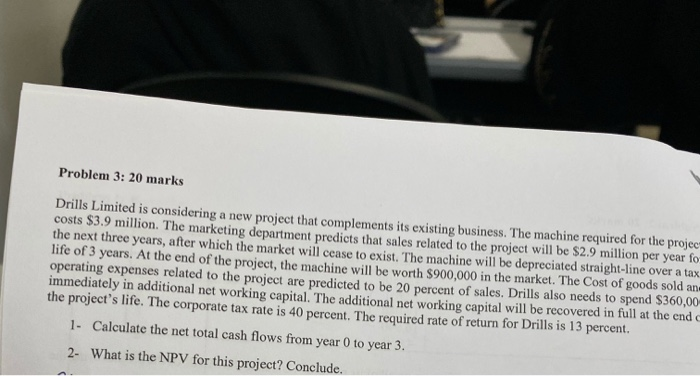

Problem 3: 20 marks Drills Limited is considering a new project that complements its existing business. The machine required for the projec costs $3.9 million. The marketing department predicts that sales related to the project will be $2.9 million per year fo the next three years, after which the market will cease to exist. The machine will be depreciated straight-line over a ta life of 3 years. At the end of the project, the machine will be worth $900,000 in the market. The Cost of goods sold at operating expenses related to the project are predicted to be 20 percent of sales. Drills also needs to spend $360,00 immediately in additional net working capital. The additional net working capital will be recovered in full at the end the project's life. The corporate tax rate is 40 percent. The required rate of return for Drills is 13 percent. 1- Calculate the net total cash flows from year 0 to year 3. 2- What is the NPV for this project? Conclude

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts