Question: Problem 3 (25 points) = Suppose the Capital Asset Pricing Model (CAPM)) is valid in a simple market. Use CAPM to explain and answer following

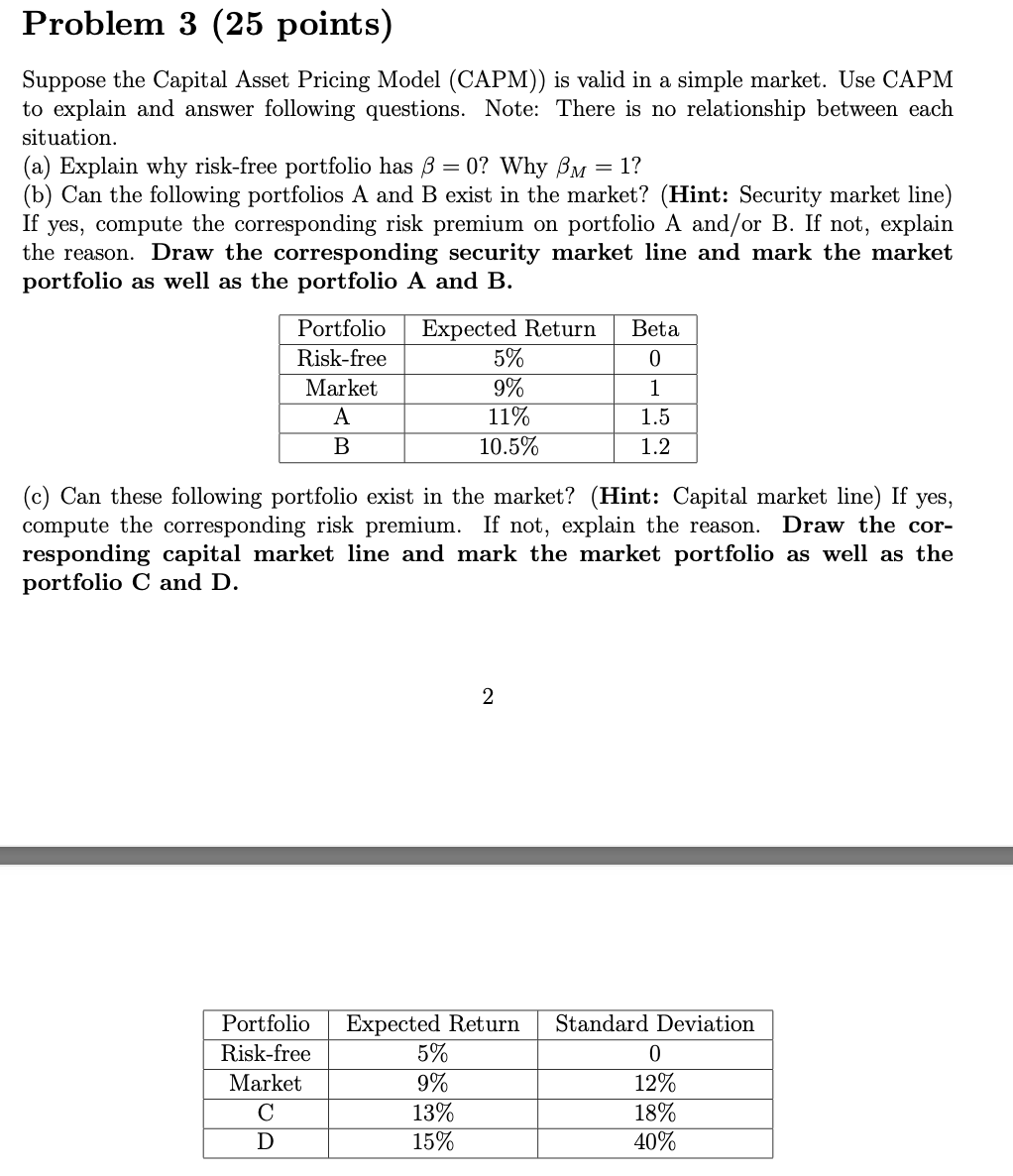

Problem 3 (25 points) = Suppose the Capital Asset Pricing Model (CAPM)) is valid in a simple market. Use CAPM to explain and answer following questions. Note: There is no relationship between each situation. (a) Explain why risk-free portfolio has B = 0? Why BM 1? (b) Can the following portfolios A and B exist in the market? (Hint: Security market line) If yes, compute the corresponding risk premium on portfolio A and/or B. If not, explain the reason. Draw the corresponding security market line and mark the market portfolio as well as the portfolio A and B. Portfolio Risk-free Market A B Expected Return 5% 9% 11% 10.5% Beta 0 1 1.5 1.2 (c) Can these following portfolio exist in the market? (Hint: Capital market line) If yes, compute the corresponding risk premium. If not, explain the reason. Draw the cor- responding capital market line and mark the market portfolio as well as the portfolio C and D. 2 Portfolio Risk-free Market D Expected Return 5% 9% 13% 15% Standard Deviation 0 12% 18% 40% Problem 3 (25 points) = Suppose the Capital Asset Pricing Model (CAPM)) is valid in a simple market. Use CAPM to explain and answer following questions. Note: There is no relationship between each situation. (a) Explain why risk-free portfolio has B = 0? Why BM 1? (b) Can the following portfolios A and B exist in the market? (Hint: Security market line) If yes, compute the corresponding risk premium on portfolio A and/or B. If not, explain the reason. Draw the corresponding security market line and mark the market portfolio as well as the portfolio A and B. Portfolio Risk-free Market A B Expected Return 5% 9% 11% 10.5% Beta 0 1 1.5 1.2 (c) Can these following portfolio exist in the market? (Hint: Capital market line) If yes, compute the corresponding risk premium. If not, explain the reason. Draw the cor- responding capital market line and mark the market portfolio as well as the portfolio C and D. 2 Portfolio Risk-free Market D Expected Return 5% 9% 13% 15% Standard Deviation 0 12% 18% 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts