Question: Problem 2 (25 points) Suppose the Capital Asset Pricing Model (CAPM)) is valid in a simple market. Use CAPM to explain and answer following questions.

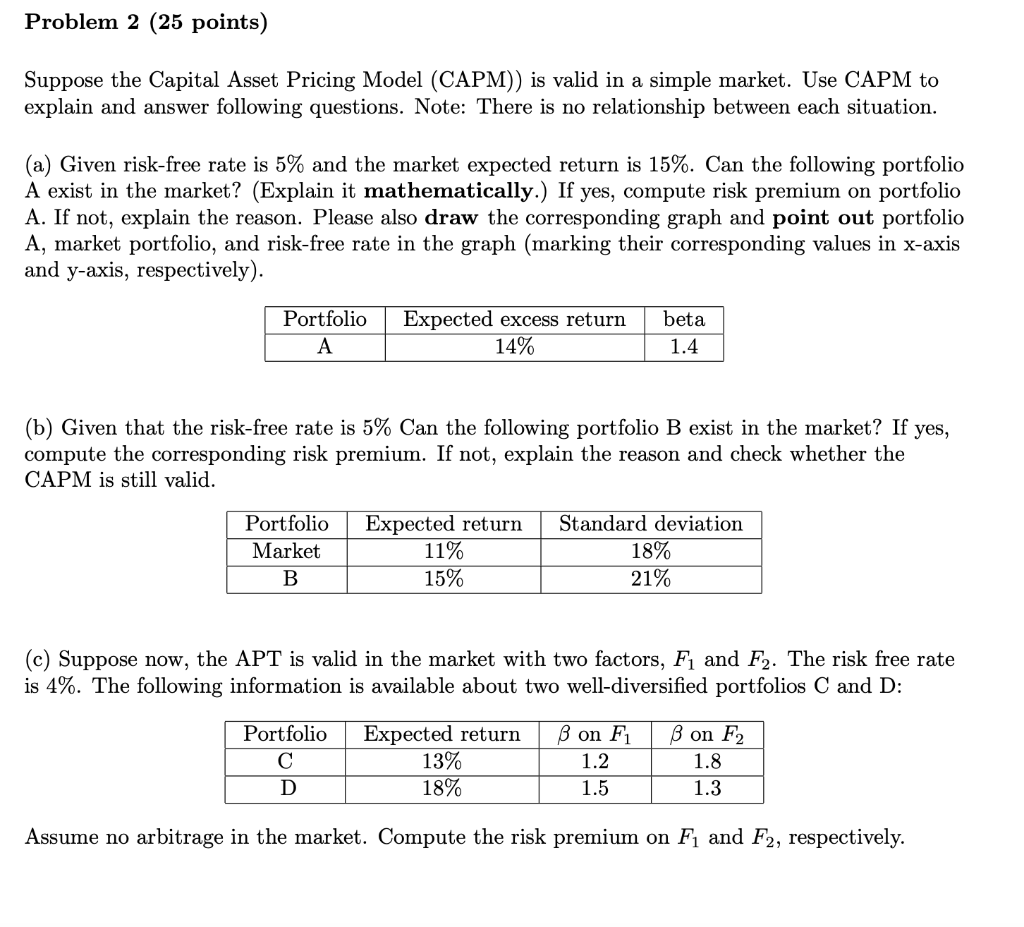

Problem 2 (25 points) Suppose the Capital Asset Pricing Model (CAPM)) is valid in a simple market. Use CAPM to explain and answer following questions. Note: There is no relationship between each situation. (a) Given risk-free rate is 5% and the market expected return is 15%. Can the following portfolio A exist in the market? (Explain it mathematically.) If yes, compute risk premium on portfolio A. If not, explain the reason. Please also draw the corresponding graph and point out portfolio A, market portfolio, and risk-free rate in the graph (marking their corresponding values in x-axis and y-axis, respectively). Portfolio A Expected excess return 14% beta 1.4 (b) Given that the risk-free rate is 5% Can the following portfolio B exist in the market? If yes, compute the corresponding risk premium. If not, explain the reason and check whether the CAPM is still valid. Portfolio Market B Expected return 11% 15% Standard deviation 18% 21% (c) Suppose now, the APT is valid in the market with two factors, Fi and F2. The risk free rate is 4%. The following information is available about two well-diversified portfolios C and D: Portfolio D Expected return 13% B on F 1.2 1.5 B on F2 1.8 1.3 18% Assume no arbitrage in the market. Compute the risk premium on Fi and F2, respectively. Problem 2 (25 points) Suppose the Capital Asset Pricing Model (CAPM)) is valid in a simple market. Use CAPM to explain and answer following questions. Note: There is no relationship between each situation. (a) Given risk-free rate is 5% and the market expected return is 15%. Can the following portfolio A exist in the market? (Explain it mathematically.) If yes, compute risk premium on portfolio A. If not, explain the reason. Please also draw the corresponding graph and point out portfolio A, market portfolio, and risk-free rate in the graph (marking their corresponding values in x-axis and y-axis, respectively). Portfolio A Expected excess return 14% beta 1.4 (b) Given that the risk-free rate is 5% Can the following portfolio B exist in the market? If yes, compute the corresponding risk premium. If not, explain the reason and check whether the CAPM is still valid. Portfolio Market B Expected return 11% 15% Standard deviation 18% 21% (c) Suppose now, the APT is valid in the market with two factors, Fi and F2. The risk free rate is 4%. The following information is available about two well-diversified portfolios C and D: Portfolio D Expected return 13% B on F 1.2 1.5 B on F2 1.8 1.3 18% Assume no arbitrage in the market. Compute the risk premium on Fi and F2, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts