Question: Problem 3 (25 points) Today, a S50 million interest rate swap has a remaining life of 9 months. Under the terms of the swap, six-month

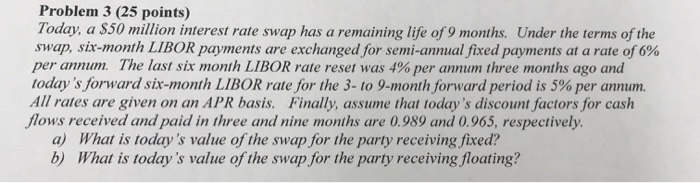

Problem 3 (25 points) Today, a S50 million interest rate swap has a remaining life of 9 months. Under the terms of the swap, six-month LIBOR payments are exchanged for semi-annual fixed payments at a rate of 6% per annum. The last six month LIBOR rate reset was 4% per annum three months ago and today's forward six-month LIBOR rate for the 3-to 9-month forward period is 5% per annum. All rates are given on an APR basis. Finally, assume that today's discount factors for cash lows received and paid in three and nine months are 0.989 and 0.965, respectively a) What is today's value of the swap for the party receiving fixed? b) What is today's value of the swap for the party receiving floating

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts