Question: Problem 3 - 3 5 ( LO . 1 , 2 , 3 , 4 , 5 , 6 ) Charlotte ( age 4 0

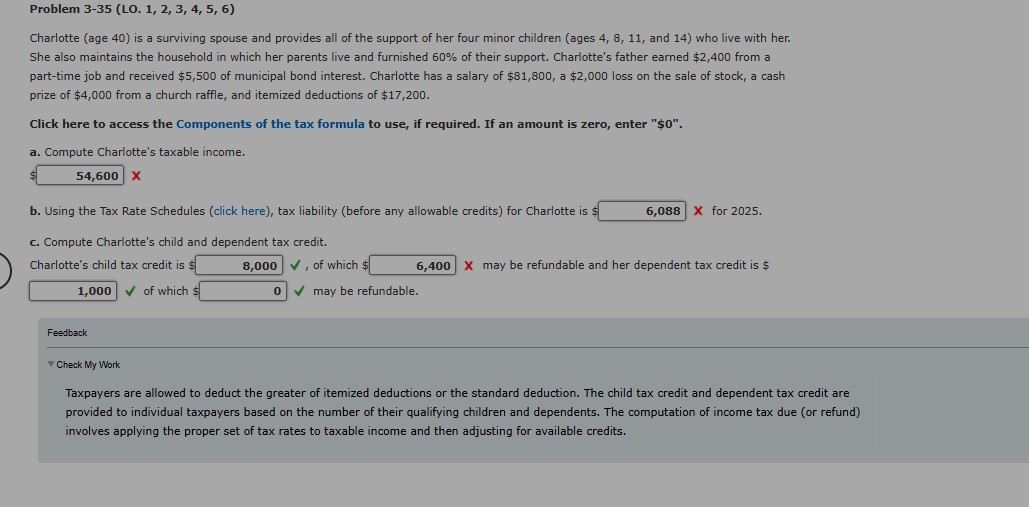

Problem LO Charlotte age is a surviving spouse and provides all of the support of her four minor children ages and who live with her. She also maintains the household in which her parents live and furnished of their support. Charlotte's father earned $ from a parttime job and received $ of municipal bond interest. Charlotte has a salary of $ a $ loss on the sale of stock, a cash prize of $ from a church raffle, and itemized deductions of $ Click here to access the Components of the tax formula to use, if required. If an amount is zero, enter $ a Compute Charlotte's taxable income. b Using the Tax Rate Schedules click here tax liability before any allowable credits for Charlotte is $ X for c Compute Charlotte's child and dependent tax credit. Charlotte's child tax credit is $ checkmark of which $ mathbfX may be refundable and her dependent tax credit is $ checkmark of which $ checkmark may be refundable. Feedback Check My Work Taxpayers are allowed to deduct the greater of itemized deductions or the standard deduction. The child tax credit and dependent tax credit are provided to individual taxpayers based on the number of their qualifying children and dependents. The computation of income tax due or refund involves applying the proper set of tax rates to taxable income and then adjusting for available credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock