Question: Problem 3. (34 points) A financial analyst wants to predict the returns of a portfolio. The portfolio gives either a return of 1 or 3

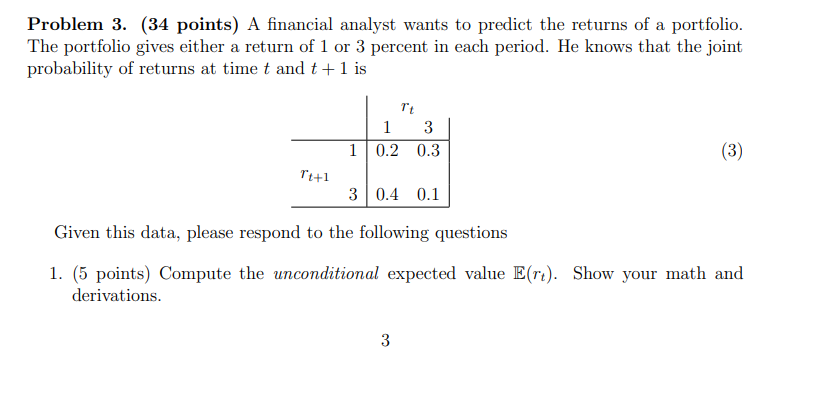

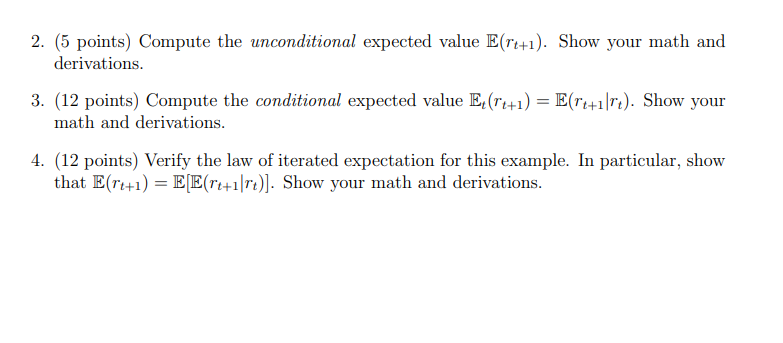

Problem 3. (34 points) A financial analyst wants to predict the returns of a portfolio. The portfolio gives either a return of 1 or 3 percent in each period. He knows that the joint probability of returns at time t and t +1 is Tt 1 3 10.2 0.3 (3) 74+1 30.4 0.1 Given this data, please respond to the following questions 1. (5 points) Compute the unconditional expected value E(rt). Show your math and derivations. 3 2. (5 points) Compute the unconditional expected value E(re+1). Show your math and derivations. 3. (12 points) Compute the conditional expected value E (+++1) = E(rt+1|rt). Show your math and derivations. 4. (12 points) Verify the law of iterated expectation for this example. In particular, show that E(T +1) = E[E(rt+1|rt)]. Show your math and derivations. Problem 3. (34 points) A financial analyst wants to predict the returns of a portfolio. The portfolio gives either a return of 1 or 3 percent in each period. He knows that the joint probability of returns at time t and t +1 is Tt 1 3 10.2 0.3 (3) 74+1 30.4 0.1 Given this data, please respond to the following questions 1. (5 points) Compute the unconditional expected value E(rt). Show your math and derivations. 3 2. (5 points) Compute the unconditional expected value E(re+1). Show your math and derivations. 3. (12 points) Compute the conditional expected value E (+++1) = E(rt+1|rt). Show your math and derivations. 4. (12 points) Verify the law of iterated expectation for this example. In particular, show that E(T +1) = E[E(rt+1|rt)]. Show your math and derivations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts