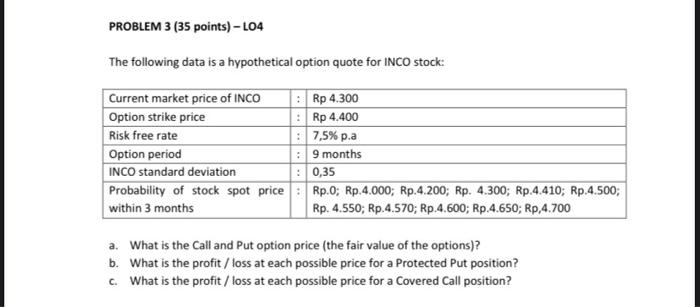

Question: PROBLEM 3 (35 points) - L04 The following data is a hypothetical option quote for INCO stock: Current market price of INCO : Rp 4.300

PROBLEM 3 (35 points) - L04 The following data is a hypothetical option quote for INCO stock: Current market price of INCO : Rp 4.300 Option strike price : Rp 4.400 Risk free rate : 7,5% pa Option period : 9 months INCO standard deviation : 0,35 Probability of stock spot price Rp.0; Rp.4.000; Rp.4.200; Rp. 4.300; Rp.4.410; Rp.4.500; within 3 months Rp. 4.550; Rp.4.570; Rp.4.600; Rp.4.650; Rp.4.700 a. What is the call and Put option price (the fair value of the options)? b. What is the profit / loss at each possible price for a Protected Put position? c. What is the profit / loss at each possible price for a Covered Call position? PROBLEM 3 (35 points) - L04 The following data is a hypothetical option quote for INCO stock: Current market price of INCO : Rp 4.300 Option strike price : Rp 4.400 Risk free rate : 7,5% pa Option period : 9 months INCO standard deviation : 0,35 Probability of stock spot price Rp.0; Rp.4.000; Rp.4.200; Rp. 4.300; Rp.4.410; Rp.4.500; within 3 months Rp. 4.550; Rp.4.570; Rp.4.600; Rp.4.650; Rp.4.700 a. What is the call and Put option price (the fair value of the options)? b. What is the profit / loss at each possible price for a Protected Put position? c. What is the profit / loss at each possible price for a Covered Call position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts