Question: Problem 3 (40 points) Use the quarterly data for the exchange rates between U.S. dollars and Euro, U.S. inflation, and U.S. interest rates provided

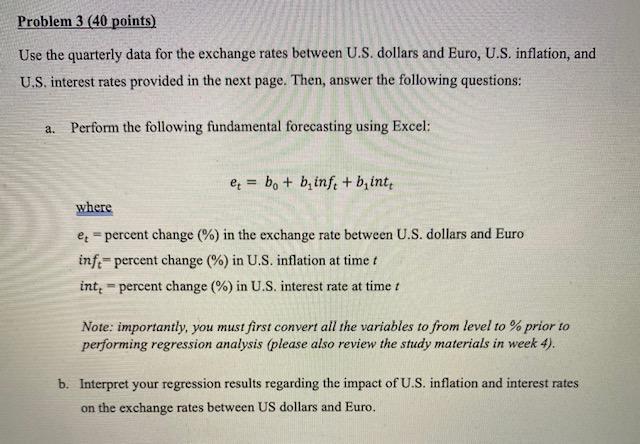

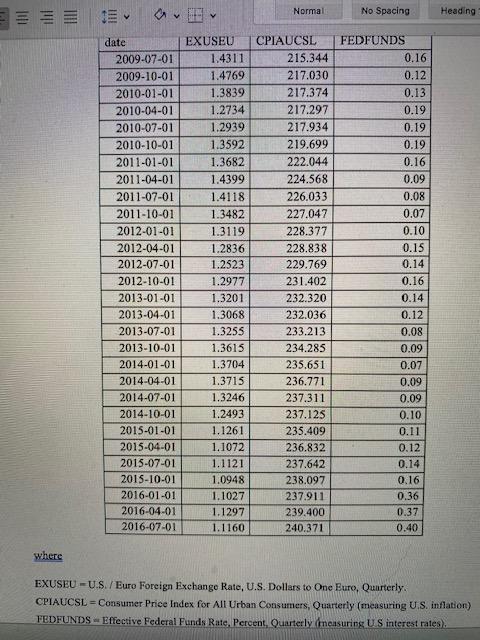

Problem 3 (40 points) Use the quarterly data for the exchange rates between U.S. dollars and Euro, U.S. inflation, and U.S. interest rates provided in the next page. Then, answer the following questions: a. Perform the following fundamental forecasting using Excel: et = bo + binf + bint, where et percent change (%) in the exchange rate between U.S. dollars and Euro inf percent change (%) in U.S. inflation at time t - int,percent change (%) in U.S. interest rate at time t Note: importantly, you must first convert all the variables to from level to % prior to performing regression analysis (please also review the study materials in week 4). b. Interpret your regression results regarding the impact of U.S. inflation and interest rates on the exchange rates between US dollars and Euro. where date 2009-07-01 2009-10-01 2010-01-01 2010-04-01 2010-07-01 2010-10-01 2011-01-01 2011-04-01 2011-07-01 2011-10-01 2012-01-01 2012-04-01 2012-07-01 2012-10-01 2013-01-01 2013-04-01 2013-07-01 2013-10-01 2014-01-01 2014-04-01 2014-07-01 2014-10-01 2015-01-01 2015-04-01 2015-07-01 2015-10-01 2016-01-01 2016-04-01 2016-07-01 EXUSEU CPIAUCSL 1.4311 1.4769 1.3839 1.2734 1.2939 1.3592 1.3682 1.4399 1.4118 1.3482 1.311 1.2836 1.2523 1.2977 1.3201 1.3068 1.3255 1.3615 1.3704 1.3715 1.3246 Normal 1.2493 1.1261 1.1072 1.1121 1.0948 1.1027 1.1297 1.1160 215.344 217.030 217.374 217.297 217.934 219.699 222.044 224.568 226.033 227.047 228.377 228.838 229.769 231.402 232.320 232.036 233.213 234.285 235,651 236.771 237.311 237.125 235.409 236.832 237.642 238.097 237.911 239.400 240.371 No Spacing FEDFUNDS 0.16 0.12 0.13 0.19 0.19 0.19 0.16 0.09 0.08 0.07 0.10 0.15 0.14 0.16 0.14 0.12 0.08 0.09 0.07 0.09 0.09 0.10 0.11 0.12 0.14 0.16 0.36 0.37 0.40 Heading EXUSEU-U.S./ Euro Foreign Exchange Rate, U.S. Dollars to One Euro, Quarterly. CPIAUCSL Consumer Price Index for All Urban Consumers, Quarterly (measuring U.S. inflation) FEDFUNDS Effective Federal Funds Rate, Percent, Quarterly measuring US interest rates).

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Answer a Perform the following fundamental forecasting using Excel The figure above shows fundamental function analysis using excel This question requires us to use the data provided in the question t... View full answer

Get step-by-step solutions from verified subject matter experts