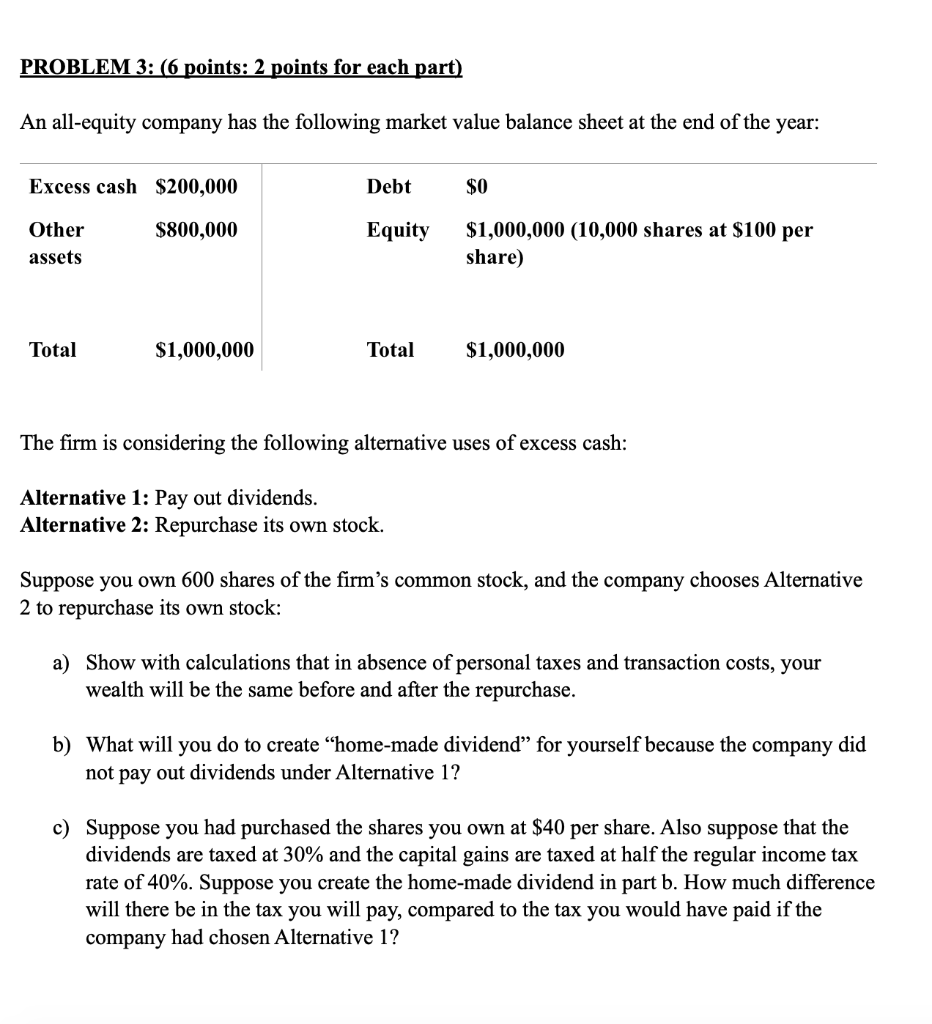

Question: PROBLEM 3: 6 points: 2 points for each part) An all-equity company has the following market value balance sheet at the end of the year:

PROBLEM 3: 6 points: 2 points for each part) An all-equity company has the following market value balance sheet at the end of the year: Excess cash $200,000 Debt $0 Other $800,000 Equity $1,000,000 (10,000 shares at $100 per share) assets Total $1,000,000 Total $1,000,000 The firm is considering the following alternative uses of excess cash: Alternative 1: Pay out dividends. Alternative 2: Repurchase its own stock. Suppose you own 600 shares of the firm's common stock, and the company chooses Alternative 2 to repurchase its own stock: a) Show with calculations that in absence of personal taxes and transaction costs, your wealth will be the same before and after the repurchase. b) What will you do to create home-made dividend for yourself because the company did not pay out dividends under Alternative 1? c) Suppose you had purchased the shares you own at $40 per share. Also suppose that the dividends are taxed at 30% and the capital gains are taxed at half the regular income tax rate of 40%. Suppose you create the home-made dividend in part b. How much difference will there be in the tax you will pay, compared to the tax you would have paid if the company had chosen Alternative 1? PROBLEM 3: 6 points: 2 points for each part) An all-equity company has the following market value balance sheet at the end of the year: Excess cash $200,000 Debt $0 Other $800,000 Equity $1,000,000 (10,000 shares at $100 per share) assets Total $1,000,000 Total $1,000,000 The firm is considering the following alternative uses of excess cash: Alternative 1: Pay out dividends. Alternative 2: Repurchase its own stock. Suppose you own 600 shares of the firm's common stock, and the company chooses Alternative 2 to repurchase its own stock: a) Show with calculations that in absence of personal taxes and transaction costs, your wealth will be the same before and after the repurchase. b) What will you do to create home-made dividend for yourself because the company did not pay out dividends under Alternative 1? c) Suppose you had purchased the shares you own at $40 per share. Also suppose that the dividends are taxed at 30% and the capital gains are taxed at half the regular income tax rate of 40%. Suppose you create the home-made dividend in part b. How much difference will there be in the tax you will pay, compared to the tax you would have paid if the company had chosen Alternative 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts