Question: Problem 3. (6 points) There is a property that will be developed two years from now, and will have today's dollar costs and revenues shown

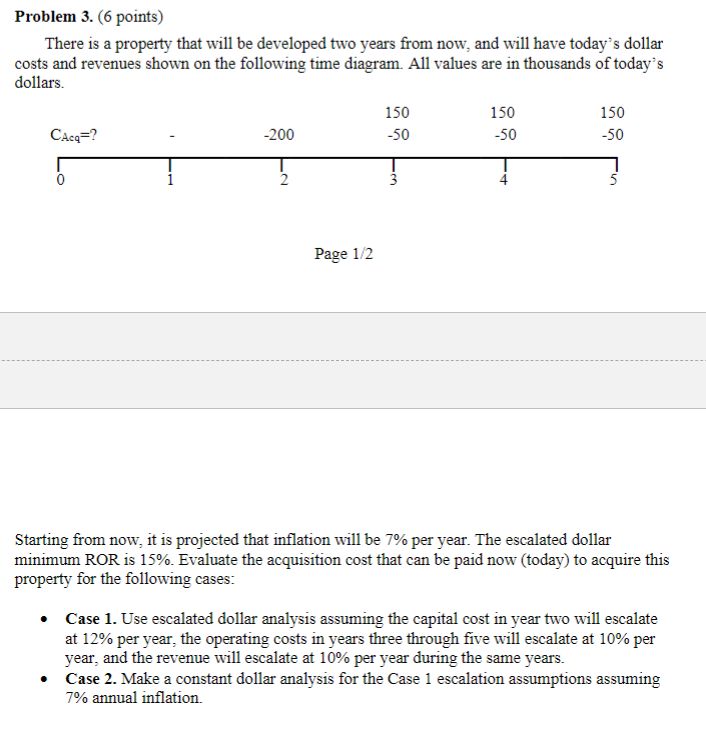

Problem 3. (6 points) There is a property that will be developed two years from now, and will have today's dollar costs and revenues shown on the following time diagram. All values are in thousands of today's dollars. 150 150 150 CAcq=? -200 -50 -50 -50 2 Page 12 Starting from now, it is projected that inflation will be 7% per year. The escalated dollar minimum ROR is 15%. Evaluate the acquisition cost that can be paid now (today) to acquire this property for the following cases: Case 1. Use escalated dollar analysis assuming the capital cost in year two will escalate at 12% per year, the operating costs in years three through five will escalate at 10% per year, and the revenue will escalate at 10% per year during the same years. Case 2. Make a constant dollar analysis for the Case 1 escalation assumptions assuming 7% annual inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts