Question: Problem 3 (8 points) Maynard Steel plans to pay a dividend of $2.92 this year. The company has an expected earnings growth rate of 3.8%

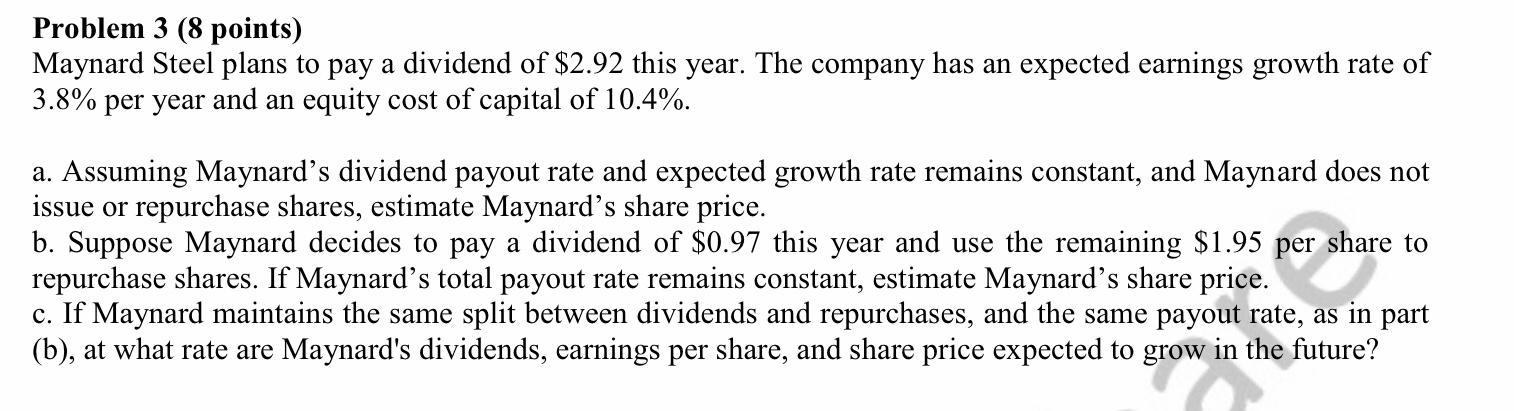

Problem 3 (8 points) Maynard Steel plans to pay a dividend of $2.92 this year. The company has an expected earnings growth rate of 3.8% per year and an equity cost of capital of 10.4%. a. Assuming Maynard's dividend payout rate and expected growth rate remains constant, and Maynard does not issue or repurchase shares, estimate Maynard's share price. b. Suppose Maynard decides to pay a dividend of $0.97 this year and use the remaining $1.95 per share to repurchase shares. If Maynard's total payout rate remains constant, estimate Maynard's share price. c. If Maynard maintains the same split between dividends and repurchases, and the same payout rate, as in part (b), at what rate are Maynard's dividends, earnings per share, and share price expected to grow in the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts