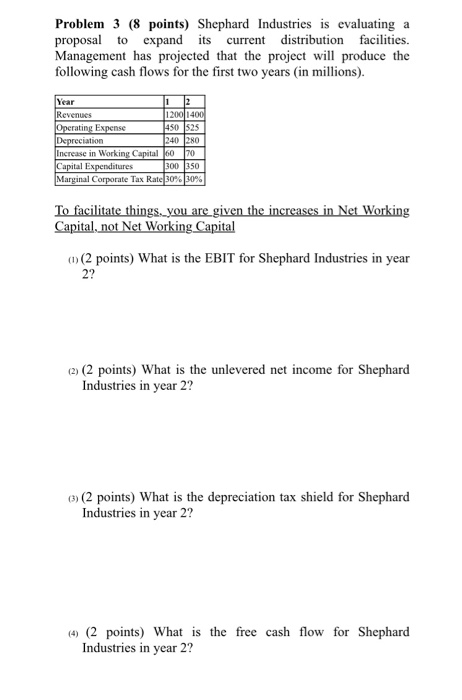

Question: Problem 3 (8 points) Shephard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected that the project will produce the

Problem 3 (8 points) Shephard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected that the project will produce the following cash flows for the first two years in millions). Year 12 Revenues 1200 1400 Operating Expense 450 525 Depreciation Increase in Working Capital 60 70 Capital Expenditures 300 350 Marginal Corporate Tax Rate 30% 30% To facilitate things you are given the increases in Net Working Capital, not Net Working Capital (1) (2 points) What is the EBIT for Shephard Industries in year () (2 points) What is the unlevered net income for Shephard Industries in year 2? (3) (2 points) What is the depreciation tax shield for Shephard Industries in year 2? (6 (2 points) What is the free cash flow Industries in year 2? for Shephard

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts