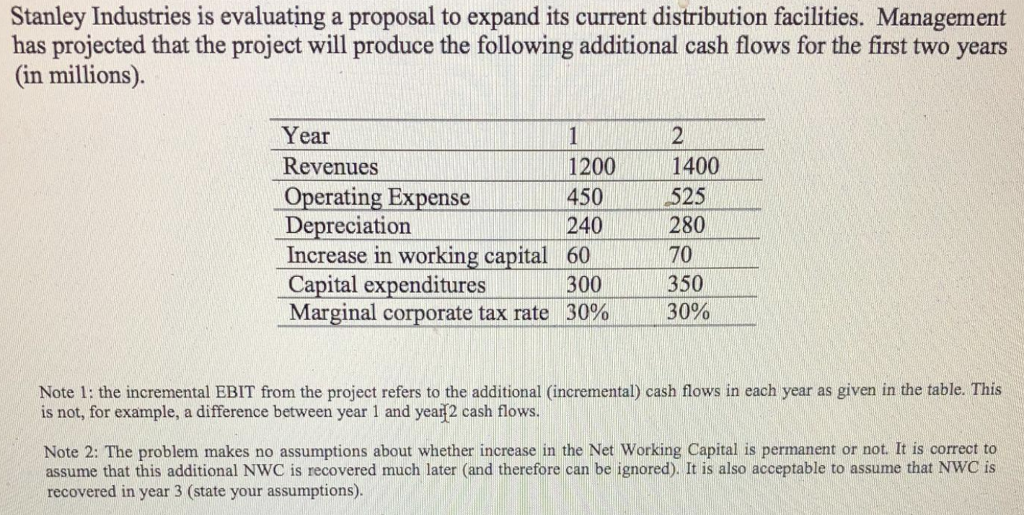

Question: Stanley Industries is evaluating a proposal to expand its current distribution facilities. Management has projected that the project will produce the following additional cash flows

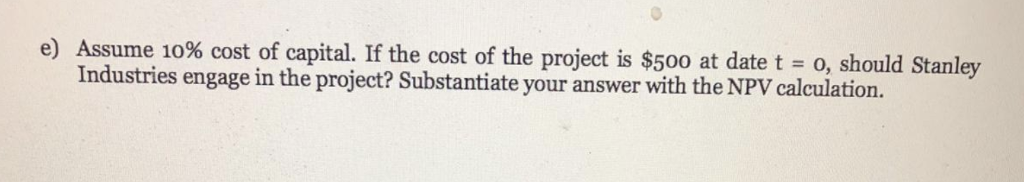

Stanley Industries is evaluating a proposal to expand its current distribution facilities. Management has projected that the project will produce the following additional cash flows for the first two years (in millions) Year Revenues Operating Expense 1200 1400 450525 240 280 Depreciation Increase in working capital 60 Capital expenditures Marginal corporate tax rate 30% 70 350 30% 300 Note 1: the incremental EBIT from the project refers to the additional (incremental) cash flows in each year as given in the table. This is not, for example, a difference between year 1 and yearf2 cash flows. Note 2: The problem makes no assumptions about whether increase in the Net Working Capital is permanent or not. It is correct to assume that this additional NWC is recovered much later (and therefore can be ignored). It is also acceptable to assume that NWC is recovered in year 3 (state your assumptions). e) Assume 10% cost of capital. If the cost of the project is $500 at date t-o, should St Industries engage in the project? Substantiate your answer with the NPV calculation. anley

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts