Question: Problem 3 A proposed process (see table below) has a lifetime of 10 years and a total fixed capital investment of $90 million (to be

Problem 3

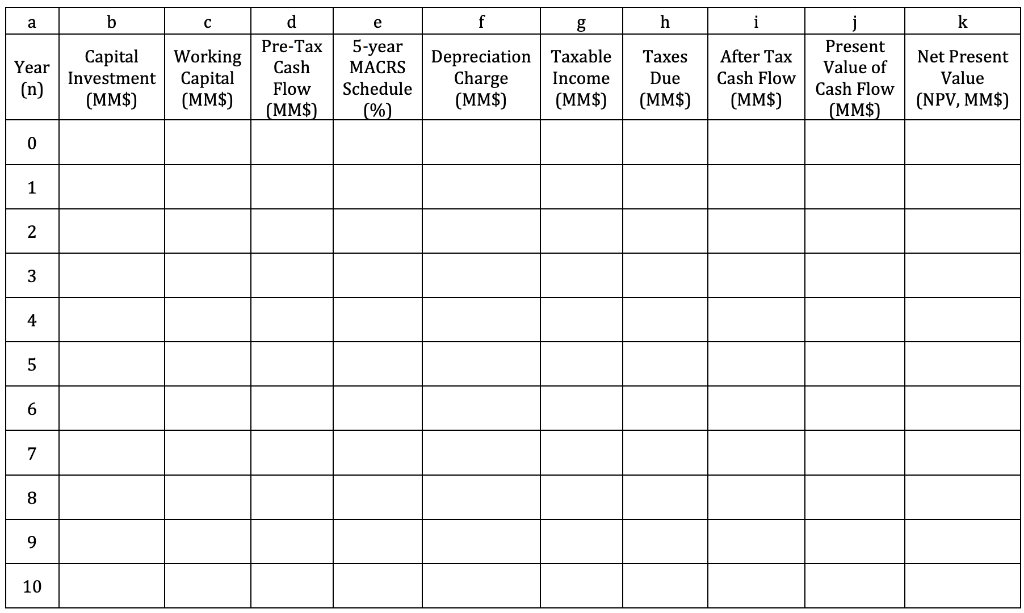

A proposed process (see table below) has a lifetime of 10 years and a total fixed capital investment of $90 million (to be committed 25% in year 0 and the rest in year 1). Just prior to startup (end of year 1), a working capital of $20 million is required. Projected annual revenues and operating expenses yield an annual pre-tax cash flow of $60 million, however the plant is projected to operate at 50% capacity in year 2. The 5-year MACRS depreciation schedule will be used for this project. The interest rate (cost of capital) is 18%, and the corporate income tax rate is 21%.

(a) Calculate the simple payback time and the pre-tax return on investment

(b) Complete the values missing in the table

(c) What is the IRR for this project?

b d i a Pre-Tax 5-year Present Depreciation Taxable Charge (MM$) Working Capital (MM$) Capital After Tax es Net Present Value of Cash Year MACRS Value Investment Cash Flow Income Due Schedule (n) Flow Cash Flow (NPV, MM$) (MM$) (MM$) (MM$) (MM$) (MM$) (%) (MM$) 2 3 4 5 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts