Question: Problem 3. Consider a binomial model with ?-0.2, ? = 0.04 and interest rate r of 5% a year. both compounded continuously. Using T =

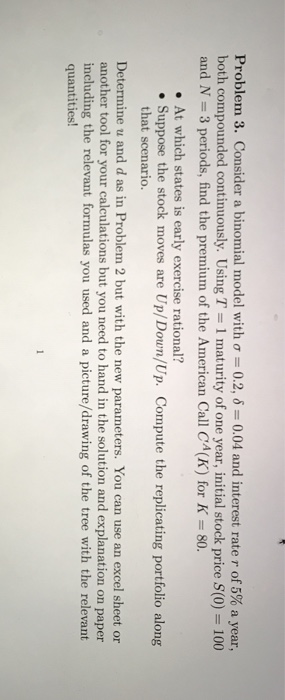

Problem 3. Consider a binomial model with ?-0.2, ? = 0.04 and interest rate r of 5% a year. both compounded continuously. Using T = i maturity of one year, initial stock price S(0-100 and N-3 periods, find the premium of the American Call CA (K) for K 80. 0 At which states is early exercise rational? Suppose the stock moves are Up/Down/Up. Compute the replicating portfolio along that scenario. Determine u and d as in Problem 2 but with the new parameters. You can use an excel sheet or another tool for your calculations but you need to hand in the solution and explanation on paper including the relevant formulas you used and a picture/drawing of the tree with the relevant quantities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts