Question: Problem #3: Consider a European put option on a stock, with a $69 strike and 1-year to expiration. The stock has a continuous [5 marks]

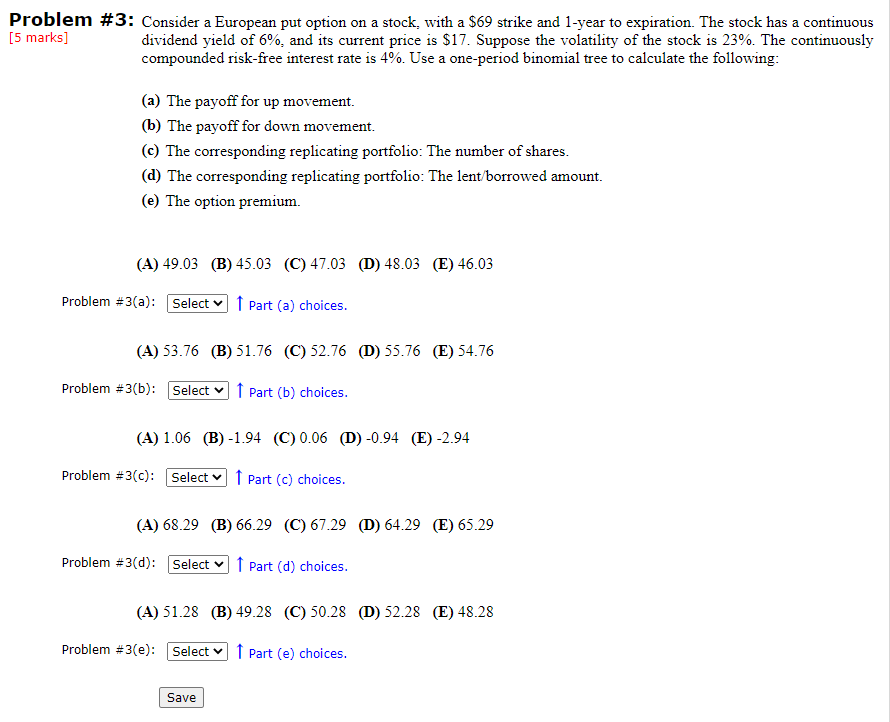

Problem #3: Consider a European put option on a stock, with a $69 strike and 1-year to expiration. The stock has a continuous [5 marks] dividend yield of 6%, and its current price is $17. Suppose the volatility of the stock is 23%. The continuously compounded risk-free interest rate is 4%. Use a one-period binomial tree to calculate the following: (a) The payoff for up movement. (b) The payoff for down movement. (c) The corresponding replicating portfolio: The number of shares. (d) The corresponding replicating portfolio: The lent/borrowed amount. (e) The option premium. (A) 49.03 (B) 45.03 (C) 47.03 (D) 48.03 (E) 46.03 Problem #3(a): Select Part (a) choices. (A) 53.76 (B) 51.76 (C) 52.76 (D) 55.76 (E) 54.76 Problem #3(b): Select 1 Part (b) choices. (A) 1.06 (B)-1.94 (C) 0.06 (D) -0.94 (E) -2.94 Problem #3(c): Select Part (c) choices. (A) 68.29 (B) 66.29 (C) 67.29 (D) 64.29 (E)65.29 Problem #3(d): Select 1 Part (d) choices. (A) 51.28 (B) 49.28 (C) 50.28 (D) 52.28 (E) 48.28 Problem #3(e): Select Part (e) choices. Save Problem #3: Consider a European put option on a stock, with a $69 strike and 1-year to expiration. The stock has a continuous [5 marks] dividend yield of 6%, and its current price is $17. Suppose the volatility of the stock is 23%. The continuously compounded risk-free interest rate is 4%. Use a one-period binomial tree to calculate the following: (a) The payoff for up movement. (b) The payoff for down movement. (c) The corresponding replicating portfolio: The number of shares. (d) The corresponding replicating portfolio: The lent/borrowed amount. (e) The option premium. (A) 49.03 (B) 45.03 (C) 47.03 (D) 48.03 (E) 46.03 Problem #3(a): Select Part (a) choices. (A) 53.76 (B) 51.76 (C) 52.76 (D) 55.76 (E) 54.76 Problem #3(b): Select 1 Part (b) choices. (A) 1.06 (B)-1.94 (C) 0.06 (D) -0.94 (E) -2.94 Problem #3(c): Select Part (c) choices. (A) 68.29 (B) 66.29 (C) 67.29 (D) 64.29 (E)65.29 Problem #3(d): Select 1 Part (d) choices. (A) 51.28 (B) 49.28 (C) 50.28 (D) 52.28 (E) 48.28 Problem #3(e): Select Part (e) choices. Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts