Question: Problem #4: Consider a European put option on a stock with a 564 strike and 1-year to expiration. The stock has a continuous 16 mais!

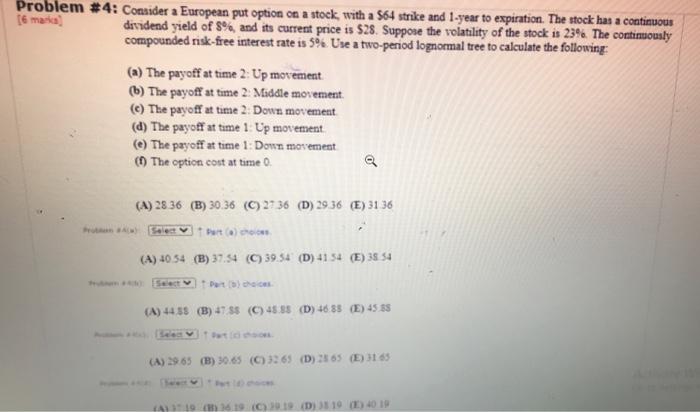

Problem #4: Consider a European put option on a stock with a 564 strike and 1-year to expiration. The stock has a continuous 16 mais! dividend yield of 8% and its current price is $28. Suppose the volatility of the stock is 23%. The continuously compounded risk-free interest rate is 5%. Use a two-period lognormal tree to calculate the following: (a) The payoff at time 2: Up movement (b) The payoff at time 2. Middle movement (C) The payoff at time 2. Down movement (d) The payoff at time 1 Up movement (@) The payoff at time 1: Down movement (1) The option cost at time 0 (A) 2836 (B) 30.36 (0)2736 (D) 29.36 (E) 31 36 (A) 40.54 (B) 37.54 (C) 39.54 (D) 4134 (E) 38 54 het to the (A) 4455 (B) 47 55 (C) 455 (D) 46 35 (E) 45 58 (A) 1965 (B) 0.65 (C) 365 (D) 365 (E) 3165 A 1946.19 (0) 19 D 19 (E) 40 19 Problem #4: Consider a European put option on a stock with a 564 strike and 1-year to expiration. The stock has a continuous 16 mais! dividend yield of 8% and its current price is $28. Suppose the volatility of the stock is 23%. The continuously compounded risk-free interest rate is 5%. Use a two-period lognormal tree to calculate the following: (a) The payoff at time 2: Up movement (b) The payoff at time 2. Middle movement (C) The payoff at time 2. Down movement (d) The payoff at time 1 Up movement (@) The payoff at time 1: Down movement (1) The option cost at time 0 (A) 2836 (B) 30.36 (0)2736 (D) 29.36 (E) 31 36 (A) 40.54 (B) 37.54 (C) 39.54 (D) 4134 (E) 38 54 het to the (A) 4455 (B) 47 55 (C) 455 (D) 46 35 (E) 45 58 (A) 1965 (B) 0.65 (C) 365 (D) 365 (E) 3165 A 1946.19 (0) 19 D 19 (E) 40 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts