Question: Problem 3: Efficient Market Hypothesis and Behavioral Finance (8 points) (a) True or false: according to the efficient markets hypothesis, you cannot predict future price

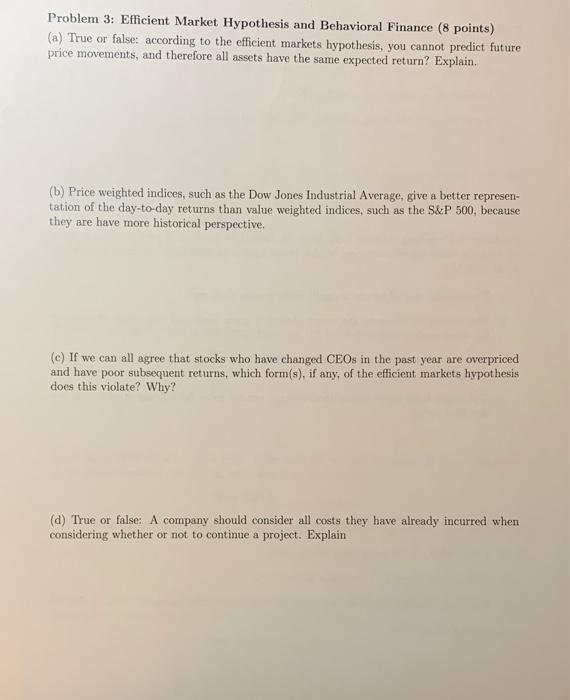

Problem 3: Efficient Market Hypothesis and Behavioral Finance (8 points) (a) True or false: according to the efficient markets hypothesis, you cannot predict future price movements, and therefore all assets have the same expected return? Explain. (b) Price weighted indices, such as the Dow Jones Industrial Average, give a better represen- tation of the day-to-day returns than value weighted indices, such as the S&P 500, because they are have more historical perspective. (c) If we can all agree that stocks who have changed CEOs in the past year are overpriced and have poor subsequent returns, which form(s), if any, of the efficient markets hypothesis does this violate? Why? (d) True or false: A company should consider all costs they have already incurred when considering whether or not to continue a project. Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts