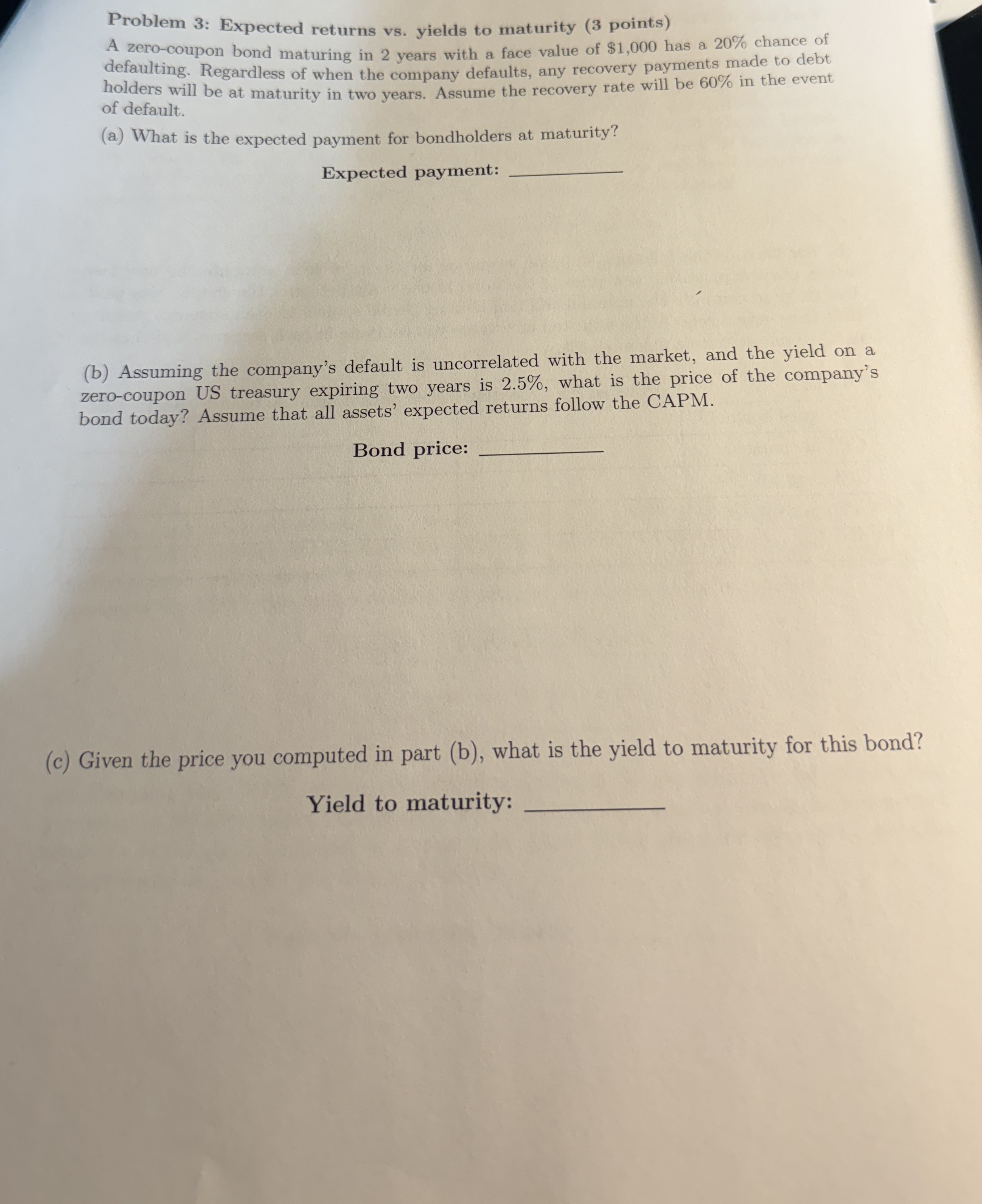

Question: Problem 3 : Expected returns vs . yields to maturity ( 3 points ) A zero - coupon bond maturing in 2 years with a

Problem : Expected returns vs yields to maturity points

A zerocoupon bond maturing in years with a face value of $ has a chance of

defaulting. Regardless of when the company defaults, any recovery payments made to debt

holders will be at maturity in two years. Assume the recovery rate will be in the event

of default.

a What is the expected payment for bondholders at maturity?

Expected payment:

b Assuming the company's default is uncorrelated with the market, and the yield on a

zerocoupon US treasury expiring two years is what is the price of the company's

bond today? Assume that all assets' expected returns follow the CAPM.

Bond price:

c Given the price you computed in part b what is the yield to maturity for this bond?

Yield to maturity:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock