Question: PROBLEM 3. FINANCING AND VALUATION (25 POINTS) IRT Inc. is expected to have S25 mln. sales next year with average 8% growth rate in past

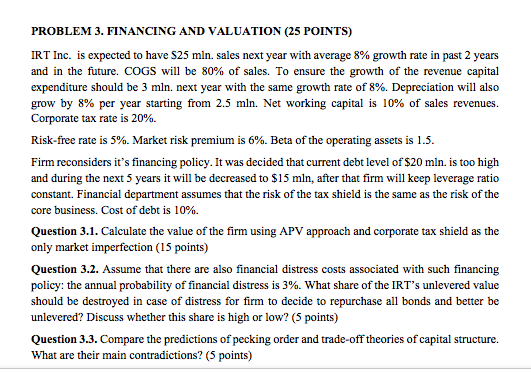

PROBLEM 3. FINANCING AND VALUATION (25 POINTS) IRT Inc. is expected to have S25 mln. sales next year with average 8% growth rate in past 2 years and in the future. COGS will be 80% of sales. To ensure the growth of the revenue capital expenditure should be 3 mln. next year with the same growth rate of 8%. Depreciation will also grow by 8% per year starting from 2.5 mln. Net working capital is 10% of sales revenues. Corporate tax rate is 20%. Risk-free rate is 5%. Market risk premium is 6%. Beta of the operating assets is 1.5. Firm reconsiders it's financing policy. It was decided that current debt level of $20 mln. is too high and during the next 5 years it will be decreased to $15 mln, after that firm will keep leverage ratio constant. Financial department assumes that the risk of the tax shield is the same as the risk of the core business. Cost of debt is 10%. Question 3.1. Calculate the value of the firm using APV approach and corporate tax shield as the only market imperfection (15 points) Question 3.2. Assume that there are also financial distress costs associated with such financing policy: the annual probability of financial distress is 3%. what share of the IRT's unlevered value should be destroyed in case of distress for firm to decide to repurchase all bonds and better be unlevered? Discuss whether this share is high or low? (5 points) Question 3.3. Compare the predictions of pecking order and trade-off theories of capital structure. What are their main contradictions? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts