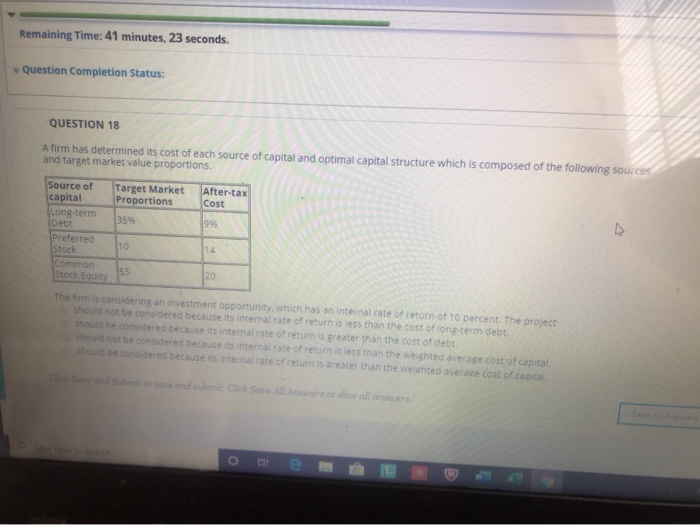

Question: Remaining Time: 41 minutes, 23 seconds. Question Completion Status: QUESTION 18 A firm has determined its cost of each source of capital and optimal capital

Remaining Time: 41 minutes, 23 seconds. Question Completion Status: QUESTION 18 A firm has determined its cost of each source of capital and optimal capital structure which is composed of the following sources and target market value proportions. Target Market Proportions After-tax Cost 35% Source of capital Long-term Debt Preferred Stock Common 110 Stock 55 The firm is considering an investment opportunty, which has an internal rate of return of 10 percent. The project Should not be considered because its internal rate of return is less than the cost of long-term debt. should be considered because its internal rate of retumis greater than the cost of debt should not be considered because its internal rate of return is less than the weighted average cost of capital should be condered because its internal rate of returns greater than the weighted average cost of capital det hel Sare All Antonellans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts