Question: Problem 3 - GST / HST Payable Note: although we did not discuss this topic in class, it is covered in the textbook, and you

Problem GSTHST Payable

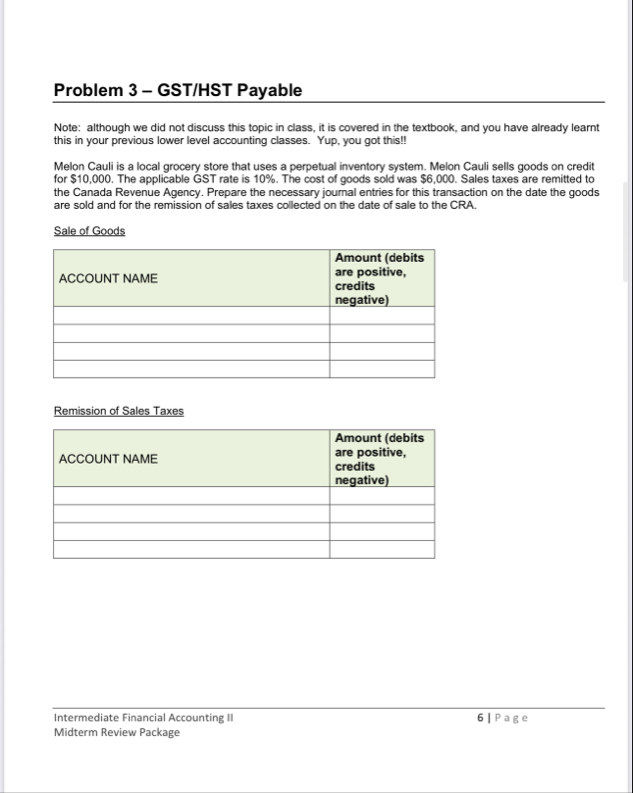

Note: although we did not discuss this topic in class, it is covered in the textbook, and you have already learnt this in your previous lower level accounting classes. Yup, you got this!!

Melon Cauli is a local grocery store that uses a perpetual inventory system. Melon Cauli sells goods on credit for $ The applicable GST rate is The cost of goods sold was $ Sales taxes are remitted to the Canada Revenue Agency. Prepare the necessary journal entries for this transaction on the date the goods are sold and for the remission of sales taxes collected on the date of sale to the CRA.

Sale of Goods

tableACCOUNT NAME,Amount debits are positive, credits negative

Remission of Sales Taxes

tableACCOUNT NAME,Amount debits are positive, credits negative

Intermediate Financial Accounting II

Page

Midterm Review Package

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock