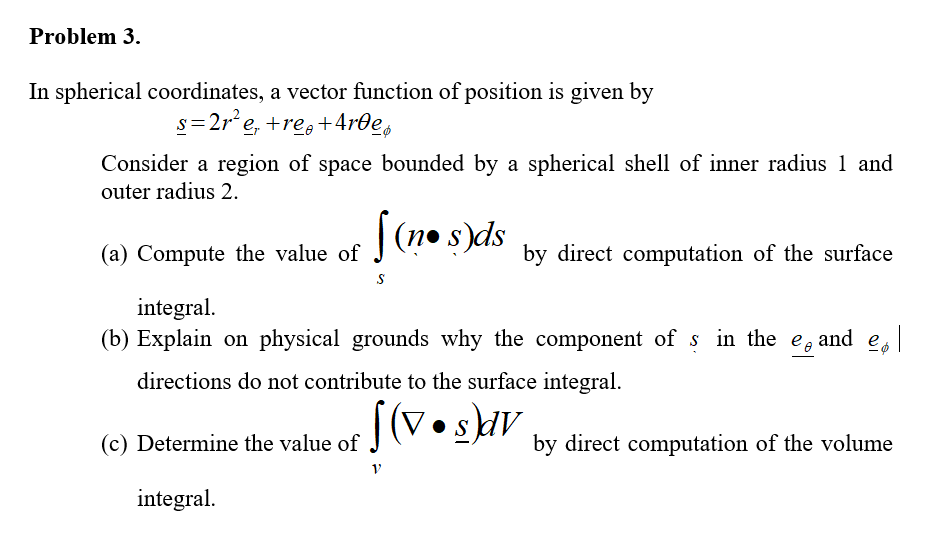

Question: Problem 3. In spherical coordinates, a vector function of position is given by s=2r e, +re+4r0e Consider a region of space bounded by a

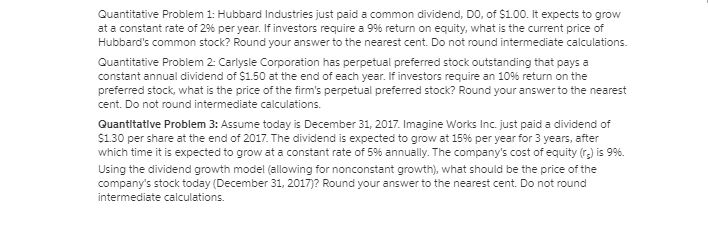

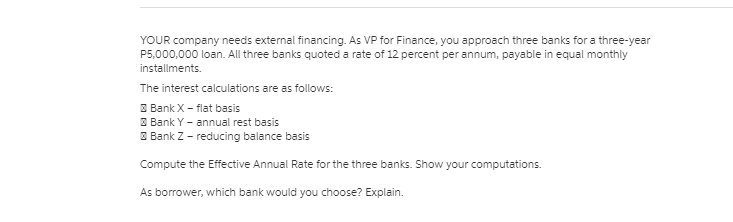

Problem 3. In spherical coordinates, a vector function of position is given by s=2r e, +re+4r0e Consider a region of space bounded by a spherical shell of inner radius 1 and outer radius 2. (a) Compute the value of (n s)ds by direct computation of the surface S integral. (b) Explain on physical grounds why the component of s in the e and directions do not contribute to the surface integral. (c) Determine the value of e (Vs)dv by direct computation of the volume integral. Quantitative Problem 1: Hubbard Industries just paid a common dividend, DO, of $1.00. It expects to grow at a constant rate of 2% per year. If investors require a 996 return on equity, what is the current price of Hubbard's common stock? Round your answer to the nearest cent. Do not round intermediate calculations. Quantitative Problem 2: Carlysle Corporation has perpetual preferred stock outstanding that pays a constant annual dividend of $1.50 at the end of each year. If investors require an 10% return on the preferred stock, what is the price of the firm's perpetual preferred stock? Round your answer to the nearest cent. Do not round intermediate calculations. Quantitative Problem 3: Assume today is December 31, 2017. Imagine Works Inc. just paid a dividend of $1.30 per share at the end of 2017. The dividend is expected to grow at 15% per year for 3 years, after which time it is expected to grow at a constant rate of 5% annually. The company's cost of equity (rc) is 99. Using the dividend growth model (allowing for nonconstant growth), what should be the price of the company's stock today (December 31, 2017)? Round your answer to the nearest cent. Do not round intermediate calculations. YOUR company needs external financing. As VP for Finance, you approach three banks for a three-year P5,000,000 loan. All three banks quoted a rate of 12 percent per annum, payable in equal monthly installments. The interest calculations are as follows: Bank X-flat basis Bank Y-annual rest basis Bank Z - reducing balance basis Compute the Effective Annual Rate for the three banks. Show your computations. As borrower, which bank would you choose? Explain.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts