Question: Problem 3. Leverage (20 points) Intel has no debt outstanding and a total market value of equity of $214 billion, and its stock is currently

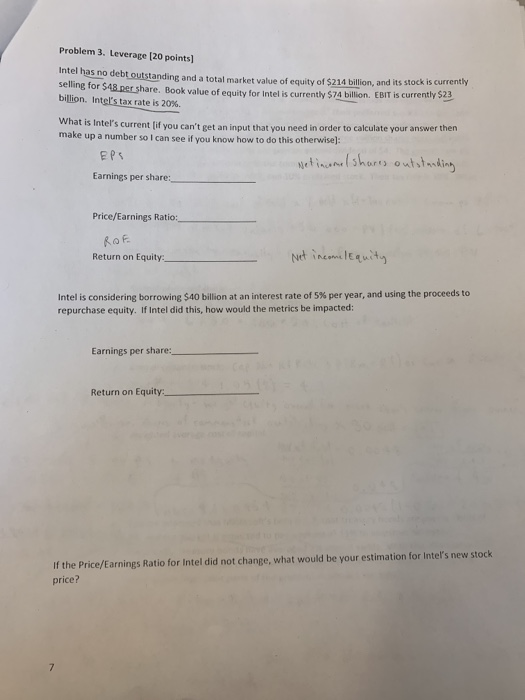

Problem 3. Leverage (20 points) Intel has no debt outstanding and a total market value of equity of $214 billion, and its stock is currently selling for S48 per share. Book value of equity for Intel is currently 574 billion. EBIT is currently 23 billion. Intel's tax rate is 20% What is Intel's current lif you can't get an input that you need in order to calculate your answer then make up a number so I can see if you know how to do this otherwise): EPS Net incomel shares outstanding Earnings per share Price/Earnings Ratio: ROF Return on Equity:__ Net income Equity Intel is considering borrowing $40 billion at an interest rate of 5% per year, and using the proceeds to repurchase equity. If Intel did this, how would the metrics be impacted: Earnings per share: Return on Equity If the Price/Earnings Ratio for Intel did not change, what would be your estimation for Intel's new stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts