Question: Problem 3: Multiple choice - computational is 0.95238. How much is the warranty provision at December Auto Co. 31, 20x1? during the a. 264,857 b.

Problem 3: Multiple choice - computational

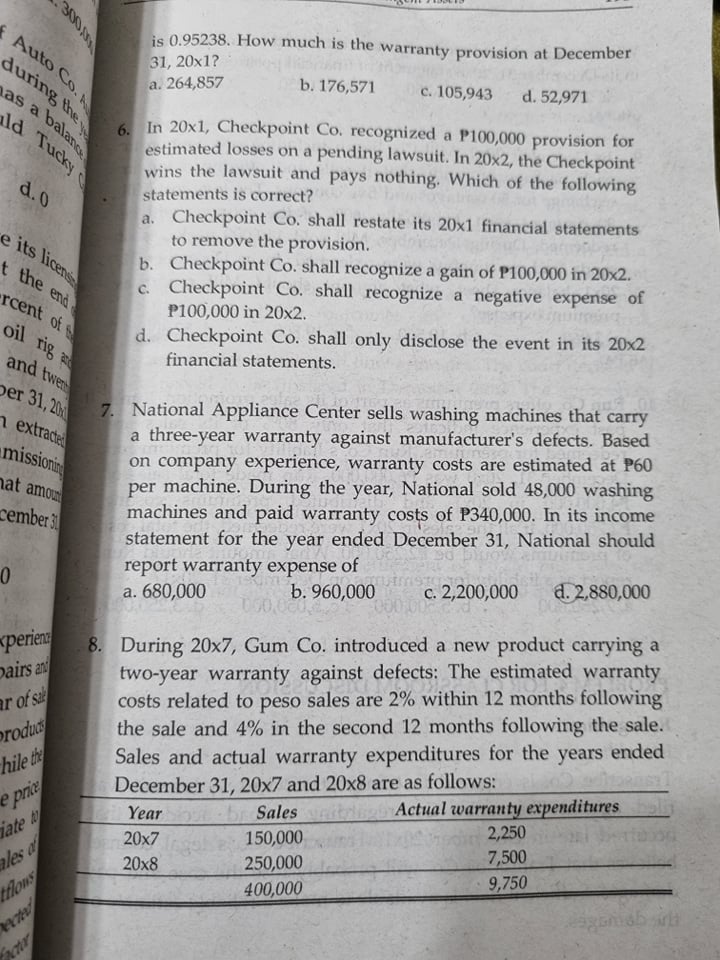

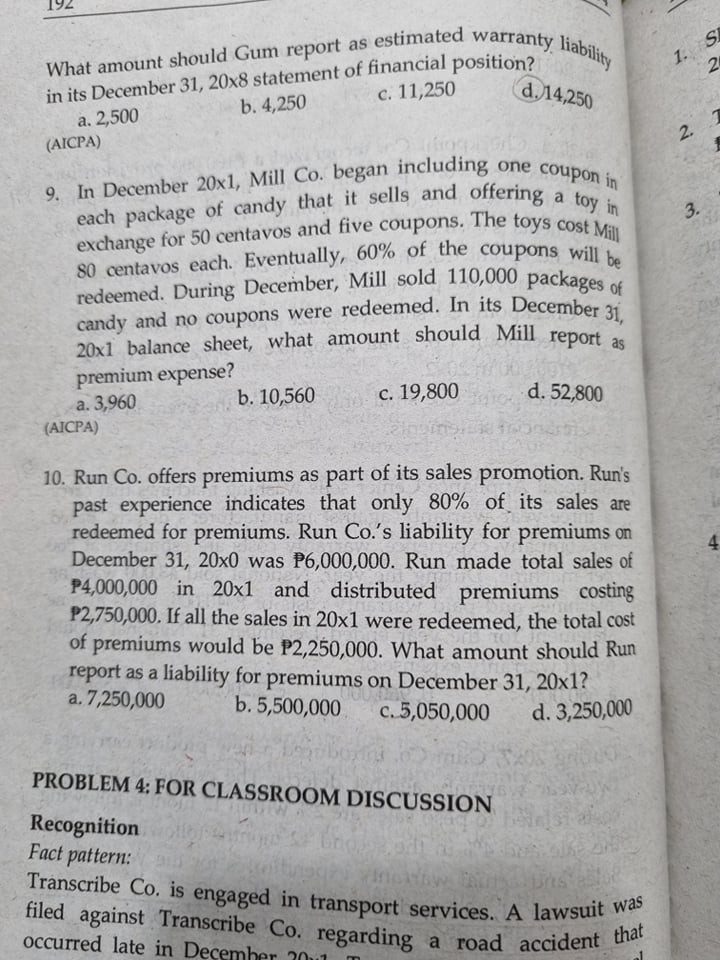

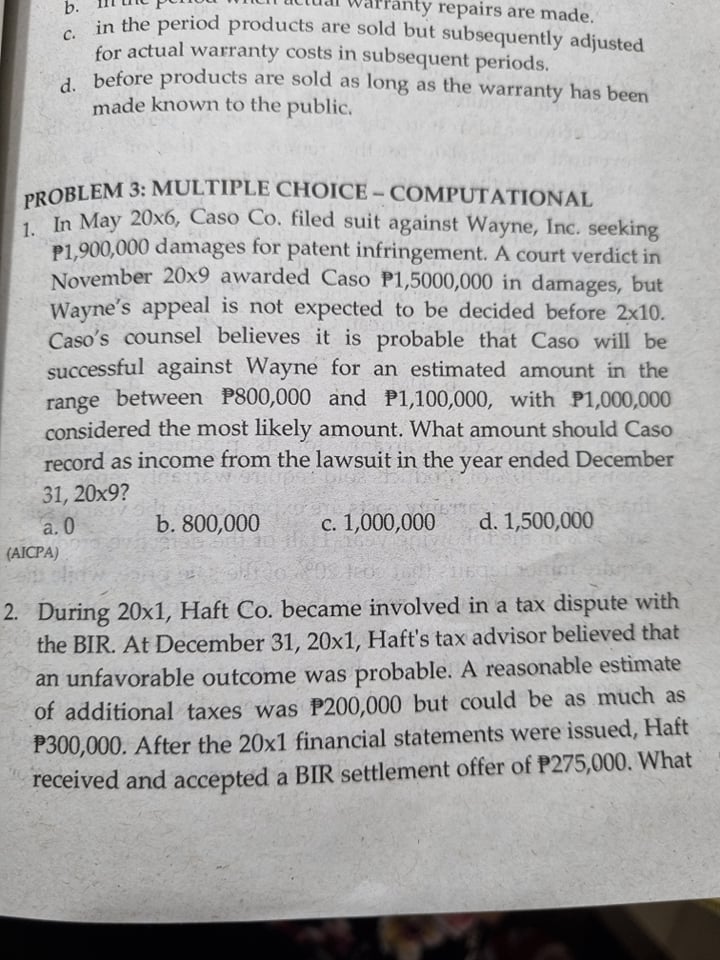

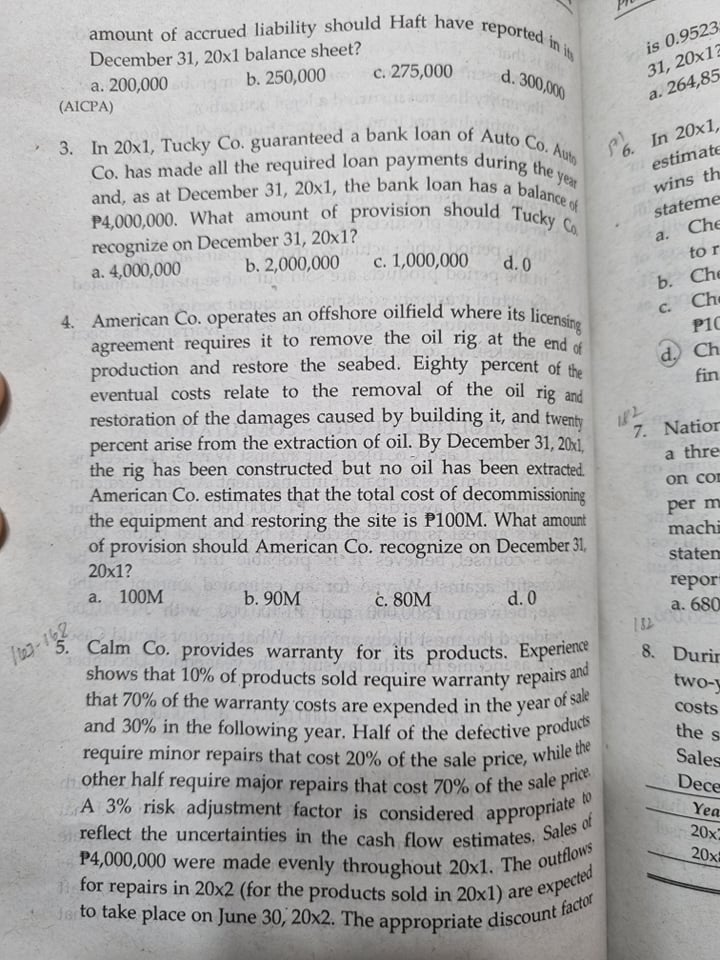

is 0.95238. How much is the warranty provision at December Auto Co. 31, 20x1? during the a. 264,857 b. 176,571 c. 105,943 d. 52,971 as a balance 6. In 20x1, Checkpoint Co. recognized a P100,000 provision for ld Tucky estimated losses on a pending lawsuit. In 20x2, the Checkpoint wins the lawsuit and pays nothing. Which of the following d.0 statements is correct? a. Checkpoint Co. shall restate its 20x1 financial statements to remove the provision. e its license b. Checkpoint Co. shall recognize a gain of P100,000 in 20x2. the end c. Checkpoint Co. shall recognize a negative expense of rcent of P100,000 in 20x2. oil rig ar d. Checkpoint Co. shall only disclose the event in its 20x2 financial statements. and twent er 31, 20x 7. National Appliance Center sells washing machines that carry 1 extracted a three-year warranty against manufacturer's defects. Based missioning on company experience, warranty costs are estimated at P60 at amount per machine. During the year, National sold 48,000 washing cember 31 machines and paid warranty costs of P340,000. In its income statement for the year ended December 31, National should 0 report warranty expense of a. 680,000 b. 960,000 C. 2,200,000 a. 2,880,000 090 perient 8. During 20x7, Gum Co. introduced a new product carrying a pairs and two-year warranty against defects: The estimated warranty r of sale costs related to peso sales are 2% within 12 months following roducts the sale and 4% in the second 12 months following the sale. hile the Sales and actual warranty expenditures for the years ended e price December 31, 20x7 and 20x8 are as follows: Year Sales with Actual warranty expenditures late to 20x7 150,000 2,250 ales of 20x8 250,000 7,500 tflows 400,000 9,750What amount should Gum report as estimated warranty liability S in its December 31, 20x8 statement of financial position? 1. 2 a. 2,500 b. 4,250 c. 11,250 d. 14,250 (AICPA) 2. 9. In December 20x1, Mill Co. began including one coupon in each package of candy that it sells and offering a toy in exchange for 50 centavos and five coupons. The toys cost Mill 3. 80 centavos each. Eventually, 60% of the coupons will be redeemed. During December, Mill sold 110,000 packages of candy and no coupons were redeemed. In its December 31, 20x1 balance sheet, what amount should Mill report as premium expense? a. 3,960 b. 10,560 c. 19,800 d. 52,800 (AICPA) 10. Run Co. offers premiums as part of its sales promotion. Run's past experience indicates that only 80% of its sales are redeemed for premiums. Run Co.'s liability for premiums on December 31, 20x0 was P6,000,000. Run made total sales of P4,000,000 in 20x1 and distributed premiums costing P2,750,000. If all the sales in 20x1 were redeemed, the total cost of premiums would be P2,250,000. What amount should Run a. 7,250,000 report as a liability for premiums on December 31, 20x1? b. 5,500,000 c. 5,050,000 d. 3,250,000 PROBLEM 4: FOR CLASSROOM DISCUSSION Recognition Fact pattern: Transcribe Co. is engaged in transport services. A lawsuit was filed against Transcribe Co. regarding a road accident that occurred late in December onb. arranty repairs are made. c. in the period products are sold but subsequently adjusted for actual warranty costs in subsequent periods. d. before products are sold as long as the warranty has been made known to the public. PROBLEM 3: MULTIPLE CHOICE - COMPUTATIONAL 1. In May 20x6, Caso Co. filed suit against Wayne, Inc. seeking P1,900,000 damages for patent infringement. A court verdict in November 20x9 awarded Caso P1,5000,000 in damages, but Wayne's appeal is not expected to be decided before 2x10. Caso's counsel believes it is probable that Caso will be successful against Wayne for an estimated amount in the range between P800,000 and P1,100,000, with P1,000,000 considered the most likely amount. What amount should Caso record as income from the lawsuit in the year ended December 31, 20x9? a. 0 b. 800,000 c. 1,000,000 d. 1,500,000 (AICPA) 2. During 20x1, Haft Co. became involved in a tax dispute with the BIR. At December 31, 20x1, Haft's tax advisor believed that an unfavorable outcome was probable. A reasonable estimate of additional taxes was P200,000 but could be as much as P300,000. After the 20x1 financial statements were issued, Haft received and accepted a BIR settlement offer of P275,000. Whatamount of accrued liability should Haft have reported in is 0.9523 December 31, 20x1 balance sheet? 31, 20x1 a. 200,000 sign b. 250,000 C. 275,000 d. 300,000 a. 264,85 (AICPA) 3. In 20x1, Tucky Co. guaranteed a bank loan of Auto Co. At $6. In 20x1 Co. has made all the required loan payments during the year estimate and, as at December 31, 20x1, the bank loan has a balance of wins th P4,000,000. What amount of provision should Tucky Co stateme recognize on December 31, 20x1? a. Che d. 0 to r a. 4,000,000 b. 2,000,000 c. 1,000,000 b. Ch 4. American Co. operates an offshore oilfield where its licensing c. Ch P10 agreement requires it to remove the oil rig at the end of d. Ch production and restore the seabed. Eighty percent of the fin eventual costs relate to the removal of the oil rig and restoration of the damages caused by building it, and twenty percent arise from the extraction of oil. By December 31, 20x1, 7. Nation a thre the rig has been constructed but no oil has been extracted. on co American Co. estimates that the total cost of decommissioning per m the equipment and restoring the site is P100M. What amount machi of provision should American Co. recognize on December 31, staten 20x1? repor a. 100M b. 90M C. 80M d. 0 a. 680 152 Calm Co. provides warranty for its products. Experience 8. Durin shows that 10% of products sold require warranty repairs and two- that 70% of the warranty costs are expended in the year of sale costs and 30% in the following year. Half of the defective products the s require minor repairs that cost 20% of the sale price, while the Sales other half require major repairs that cost 70% of the sale price. Dec A 3% risk adjustment factor is considered appropriate to Yea reflect the uncertainties in the cash flow estimates, Sales of 20x P4,000,000 were made evenly throughout 20x1. The outflows 20x for repairs in 20x2 (for the products sold in 20x1) are expected to take place on June 30, 20x2. The appropriate discount factor