Question: Problem 3 (one-period real estate development) Suppose that you consider to buy a piece of land to build apartments and then sell the apartments

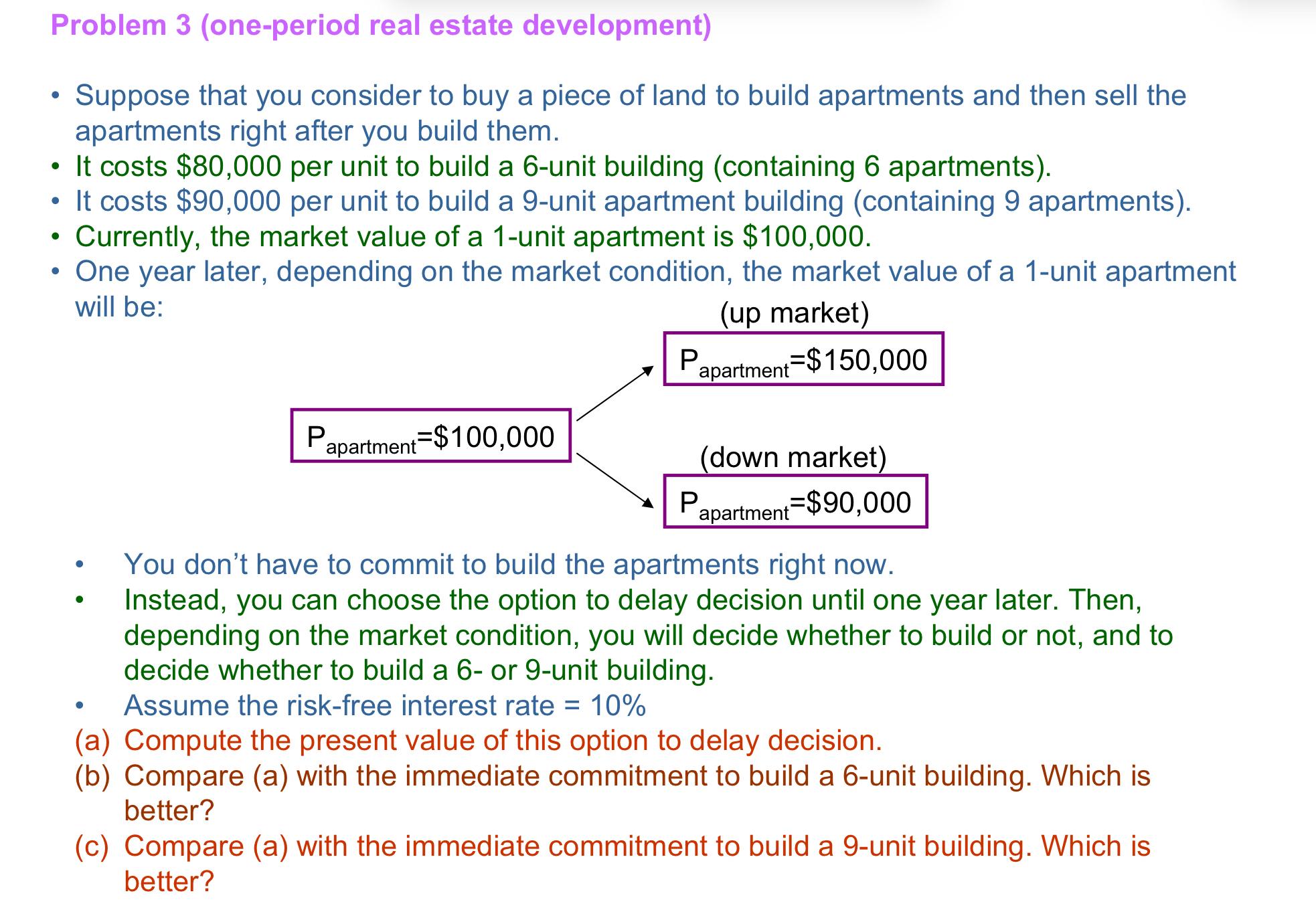

Problem 3 (one-period real estate development) Suppose that you consider to buy a piece of land to build apartments and then sell the apartments right after you build them. It costs $80,000 per unit to build a 6-unit building (containing 6 apartments). It costs $90,000 per unit to build a 9-unit apartment building (containing 9 apartments). Currently, the market value of a 1-unit apartment is $100,000. One year later, depending on the market condition, the market value of a 1-unit apartment will be: (up market) P apartment $150,000 P apartment $100,000 (down market) P apartment $90,000 You don't have to commit to build the apartments right now. Instead, you can choose the option to delay decision until one year later. Then, depending on the market condition, you will decide whether to build or not, and to decide whether to build a 6- or 9-unit building. . Assume the risk-free interest rate = 10% (a) Compute the present value of this option to delay decision. (b) Compare (a) with the immediate commitment to build a 6-unit building. Which is better? (c) Compare (a) with the immediate commitment to build a 9-unit building. Which is better?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts