Question: PROBLEM 3. (PROBLEM 1/2 ARE FOR REFERENCE) Problem 1 Suppose that two factors have been identied for the U.S. economy: the market return (MKT) and

PROBLEM 3. (PROBLEM 1/2 ARE FOR REFERENCE)

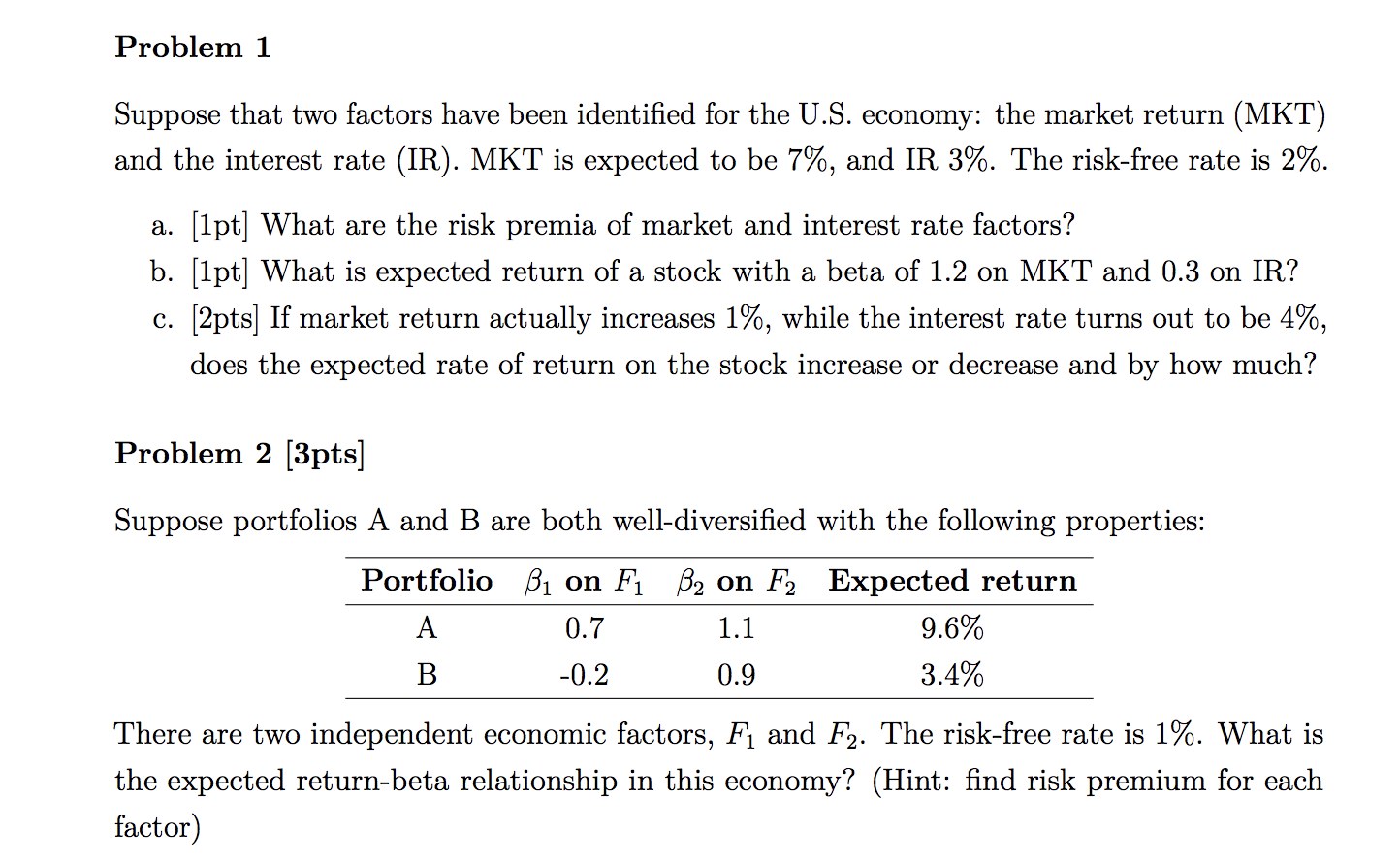

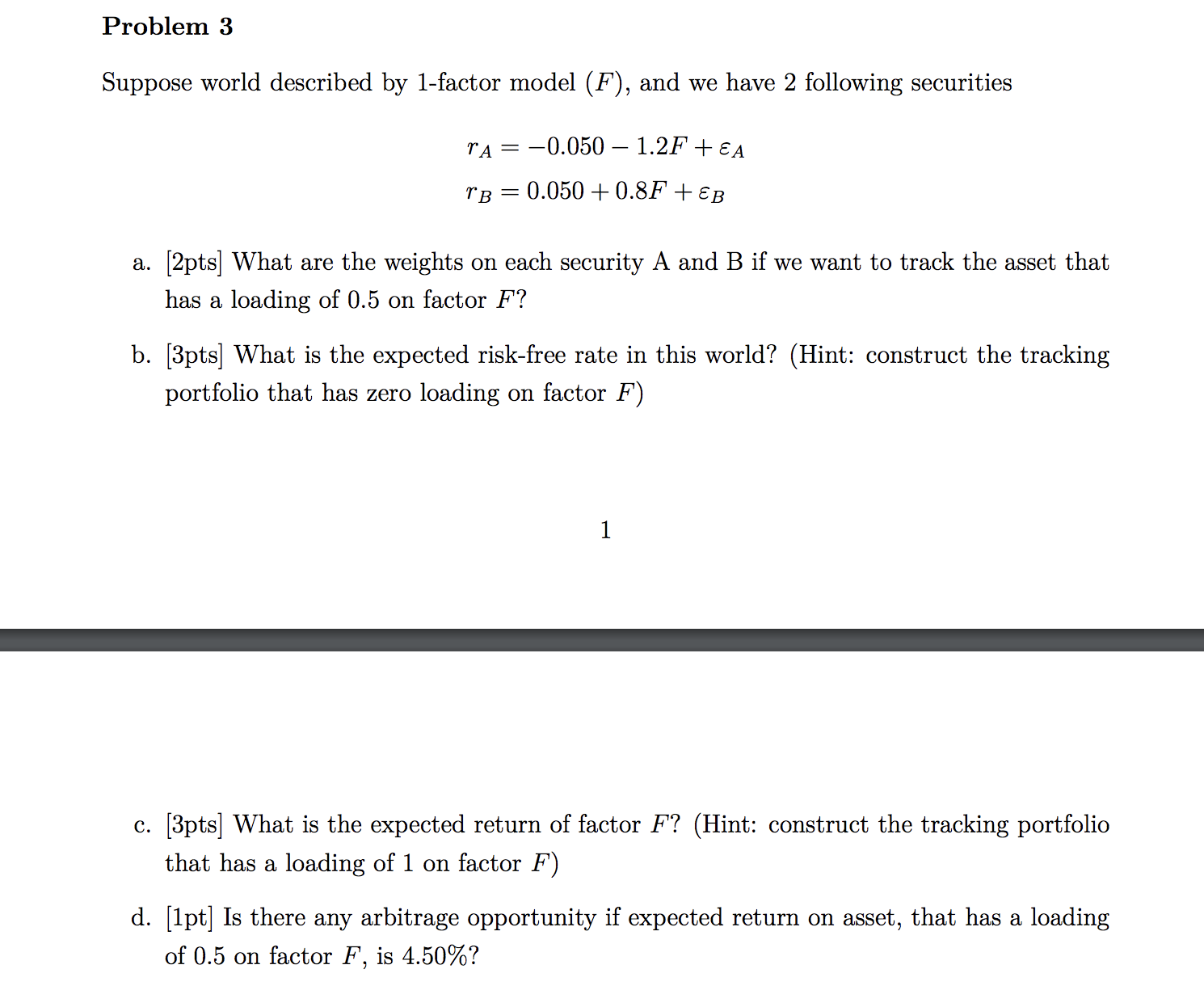

Problem 1 Suppose that two factors have been identied for the U.S. economy: the market return (MKT) and the interest rate (IR). MKT is expected to be 7%, and IR 3%. The riskfree rate is 2%. a. [1pt] What are the risk premia of market and interest rate factors? b. [1pt] What is expected return of a stock with a beta of 1.2 on MKT and 0.3 on IR? 0. [2pts] If market return actually increases 1%, while the interest rate turns out to be 4%, does the expected rate of return on the stock increase or decrease and by how much? Problem 2 [3pts] Suppose portfolios A and B are both welldiversied with the following properties: Portfolio l on F1 32 on F2 Expected return A 0.7 1.1 9.6% B 0.2 0.9 3.4% There are two independent economic factors, F1 and F2. The riskfree rate is 1%. What is the expected returnbeta relationship in this economy? (Hint: nd risk premium for each fact or) Problem 3 Suppose world described by 1factor model (F ), and we have 2 following securities 734 = 0.050 1.2F + EA T3 = 0.050 + 0.8F + 53 a. [2pts] What are the weights on each security A and B if we want to track the asset that has a loading of 0.5 on factor F? b. [3pts] What is the expected riskfree rate in this world? (Hint: construct the tracking portfolio that has zero loading on factor F) c. [3pts] What is the expected return of factor F ? (Hint: construct the tracking portfolio that has a loading of 1 on factor F) d. [1pt] Is there any arbitrage opportunity if expected return on asset, that has a loading of 0.5 on factor F, is 4.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts