Question: Problem 3: Risk Estimation Compute the correlation matrix for the asset allocation universe of fUS Treasuries, US IG Credit, US HY Credit, Large Cap Stocks,

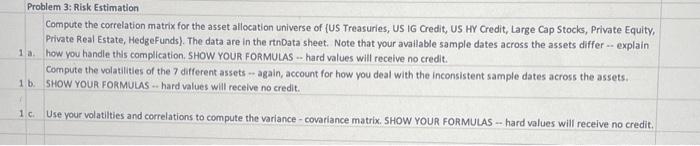

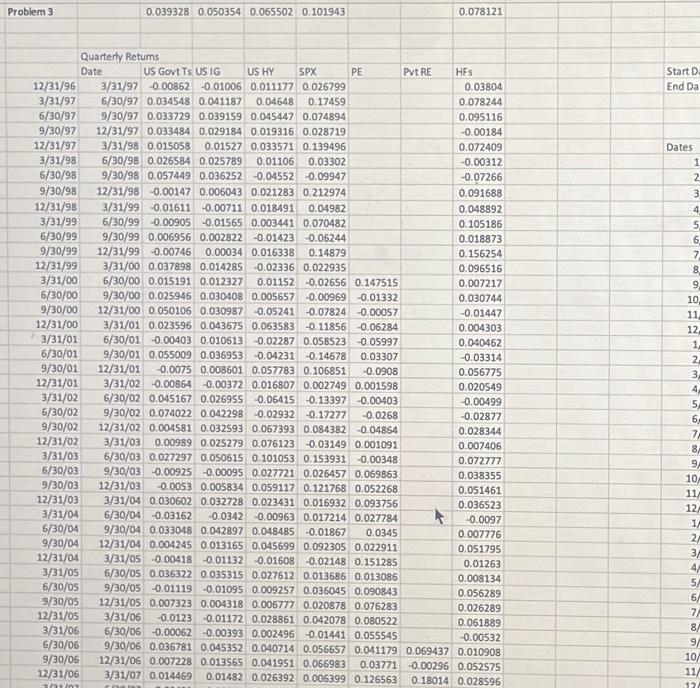

Problem 3: Risk Estimation Compute the correlation matrix for the asset allocation universe of fUS Treasuries, US IG Credit, US HY Credit, Large Cap Stocks, Private Equity, Private Real Estate, HedgeFunds). The data are in the rtnData sheet. Note that your avallable sample dates across the assets differ - explain 1. how you handle this complication. SHOW YOUR FORMULAS - hard values will receive no credit. Compute the volatilities of the 7 different assets - again, account for how you deal with the inconsistent sample dates across the assets. 1 b. SHOW YOUR FORMULAS \\( \\ldots \\) hard values will recelve no credit. 1c. Use your volatilties and correlations to compute the variance-covariance matrix. SHOW YOUR FORMULAS - hard values will receive no credit. Problem 3: Risk Estimation Compute the correlation matrix for the asset allocation universe of fUS Treasuries, US IG Credit, US HY Credit, Large Cap Stocks, Private Equity, Private Real Estate, HedgeFunds). The data are in the rtnData sheet. Note that your avallable sample dates across the assets differ - explain 1. how you handle this complication. SHOW YOUR FORMULAS - hard values will receive no credit. Compute the volatilities of the 7 different assets - again, account for how you deal with the inconsistent sample dates across the assets. 1 b. SHOW YOUR FORMULAS \\( \\ldots \\) hard values will recelve no credit. 1c. Use your volatilties and correlations to compute the variance-covariance matrix. SHOW YOUR FORMULAS - hard values will receive no credit.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts