Question: Problem 3. You are a market maker for options on a stock. You have just written one European call option on the stock with a

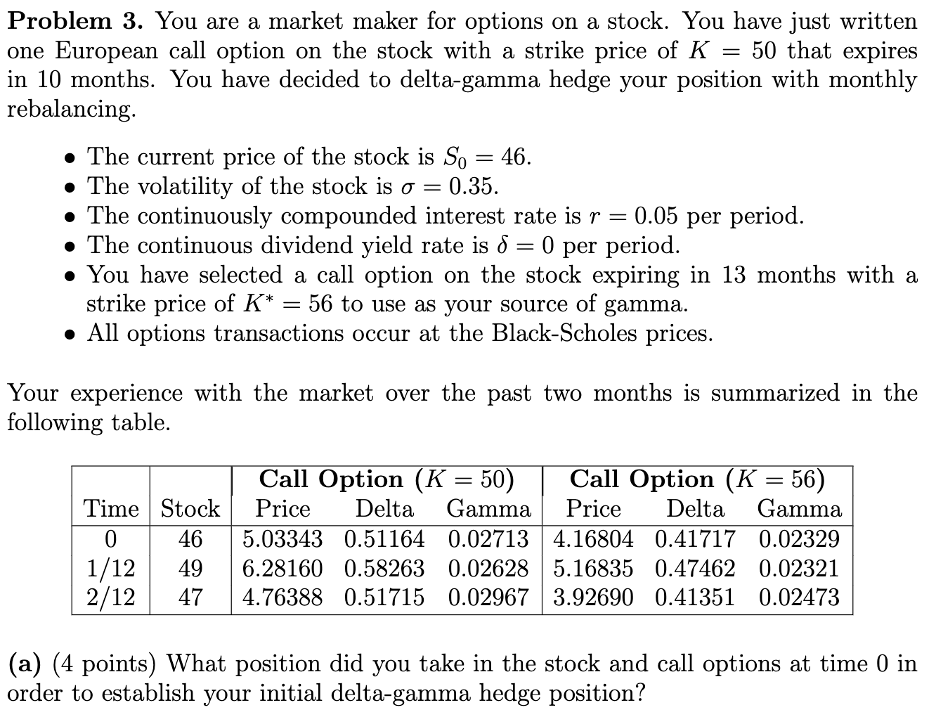

Problem 3. You are a market maker for options on a stock. You have just written one European call option on the stock with a strike price of K=50 that expires in 10 months. You have decided to delta-gamma hedge your position with monthly rebalancing. - The current price of the stock is S0=46. - The volatility of the stock is =0.35. - The continuously compounded interest rate is r=0.05 per period. - The continuous dividend yield rate is =0 per period. - You have selected a call option on the stock expiring in 13 months with a strike price of K=56 to use as your source of gamma. - All options transactions occur at the Black-Scholes prices. Your experience with the market over the past two months is summarized in the following table. (a) (4 points) What position did you take in the stock and call options at time 0 in order to establish your initial delta-gamma hedge position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts