Question: Problem 3. You are a market maker for options on a stock. You have just written one European call option on the stock with a

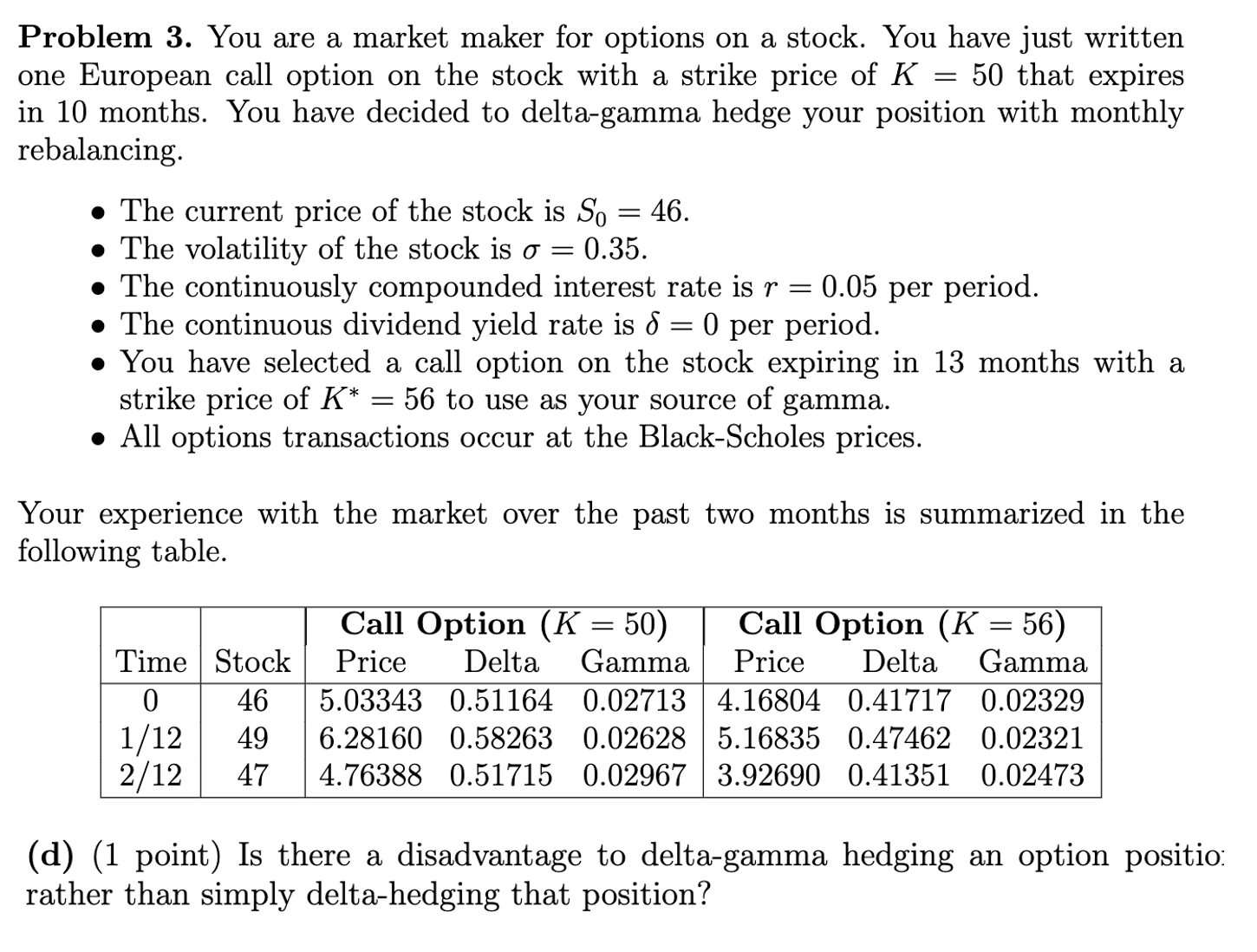

Problem 3. You are a market maker for options on a stock. You have just written one European call option on the stock with a strike price of K=50 that expires in 10 months. You have decided to delta-gamma hedge your position with monthly rebalancing. - The current price of the stock is S0=46. - The volatility of the stock is =0.35. - The continuously compounded interest rate is r=0.05 per period. - The continuous dividend yield rate is =0 per period. - You have selected a call option on the stock expiring in 13 months with a strike price of K=56 to use as your source of gamma. - All options transactions occur at the Black-Scholes prices. Your experience with the market over the past two months is summarized in the following table. (d) (1 point) Is there a disadvantage to delta-gamma hedging an option positio: rather than simply delta-hedging that position? Problem 3. You are a market maker for options on a stock. You have just written one European call option on the stock with a strike price of K=50 that expires in 10 months. You have decided to delta-gamma hedge your position with monthly rebalancing. - The current price of the stock is S0=46. - The volatility of the stock is =0.35. - The continuously compounded interest rate is r=0.05 per period. - The continuous dividend yield rate is =0 per period. - You have selected a call option on the stock expiring in 13 months with a strike price of K=56 to use as your source of gamma. - All options transactions occur at the Black-Scholes prices. Your experience with the market over the past two months is summarized in the following table. (d) (1 point) Is there a disadvantage to delta-gamma hedging an option positio: rather than simply delta-hedging that position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts