Question: Problem 3 You have been tasked to value a 2,000-square foot CBD office building fully leased to a single tenant under a triple-net, 6-year lease

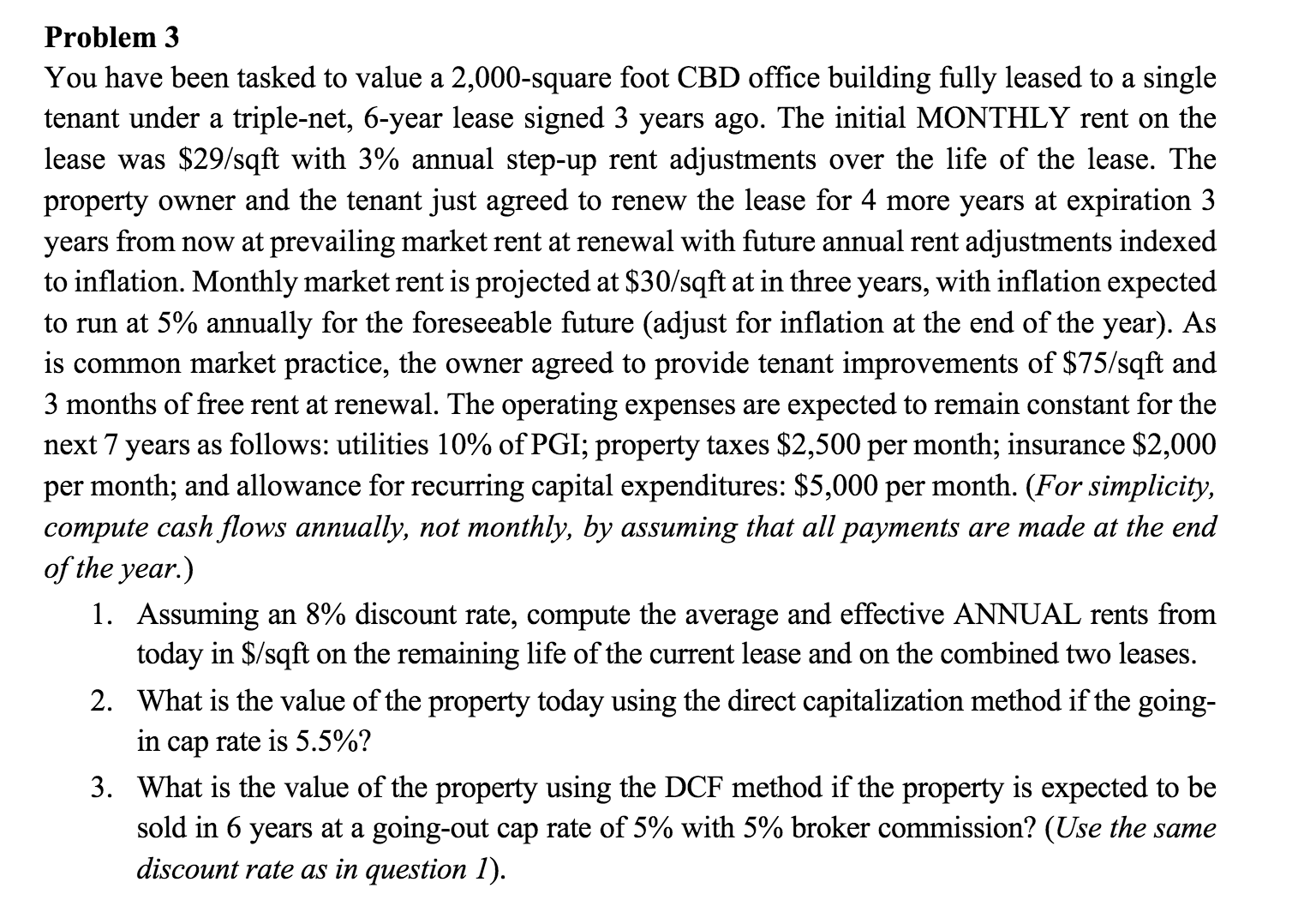

Problem 3 You have been tasked to value a 2,000-square foot CBD office building fully leased to a single tenant under a triple-net, 6-year lease signed 3 years ago. The initial MONTHLY rent on the lease was $29/sqft with 3% annual step-up rent adjustments over the life of the lease. The property owner and the tenant just agreed to renew the lease for 4 more years at expiration 3 years from now at prevailing market rent at renewal with future annual rent adjustments indexed to inflation. Monthly market rent is projected at $30/sqft at in three years, with inflation expected to run at 5% annually for the foreseeable future (adjust for inflation at the end of the year). As is common market practice, the owner agreed to provide tenant improvements of $75/sqft and 3 months of free rent at renewal. The operating expenses are expected to remain constant for the next 7 years as follows: utilities 10% of PGI; property taxes $2,500 per month; insurance $2,000 per month; and allowance for recurring capital expenditures: $5,000 per month. (For simplicity, compute cash flows annually, not monthly, by assuming that all payments are made at the end of the year.) 1. Assuming an 8% discount rate, compute the average and effective ANNUAL rents from today in $/sqft on the remaining life of the current lease and on the combined two leases. 2. What is the value of the property today using the direct capitalization method if the going- in cap rate is 5.5%? 3. What is the value of the property using the DCF method if the property is expected to be sold in 6 years at a going-out cap rate of 5% with 5% broker commission? (Use the same discount rate as in question 1). Problem 3 You have been tasked to value a 2,000-square foot CBD office building fully leased to a single tenant under a triple-net, 6-year lease signed 3 years ago. The initial MONTHLY rent on the lease was $29/sqft with 3% annual step-up rent adjustments over the life of the lease. The property owner and the tenant just agreed to renew the lease for 4 more years at expiration 3 years from now at prevailing market rent at renewal with future annual rent adjustments indexed to inflation. Monthly market rent is projected at $30/sqft at in three years, with inflation expected to run at 5% annually for the foreseeable future (adjust for inflation at the end of the year). As is common market practice, the owner agreed to provide tenant improvements of $75/sqft and 3 months of free rent at renewal. The operating expenses are expected to remain constant for the next 7 years as follows: utilities 10% of PGI; property taxes $2,500 per month; insurance $2,000 per month; and allowance for recurring capital expenditures: $5,000 per month. (For simplicity, compute cash flows annually, not monthly, by assuming that all payments are made at the end of the year.) 1. Assuming an 8% discount rate, compute the average and effective ANNUAL rents from today in $/sqft on the remaining life of the current lease and on the combined two leases. 2. What is the value of the property today using the direct capitalization method if the going- in cap rate is 5.5%? 3. What is the value of the property using the DCF method if the property is expected to be sold in 6 years at a going-out cap rate of 5% with 5% broker commission? (Use the same discount rate as in question 1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts