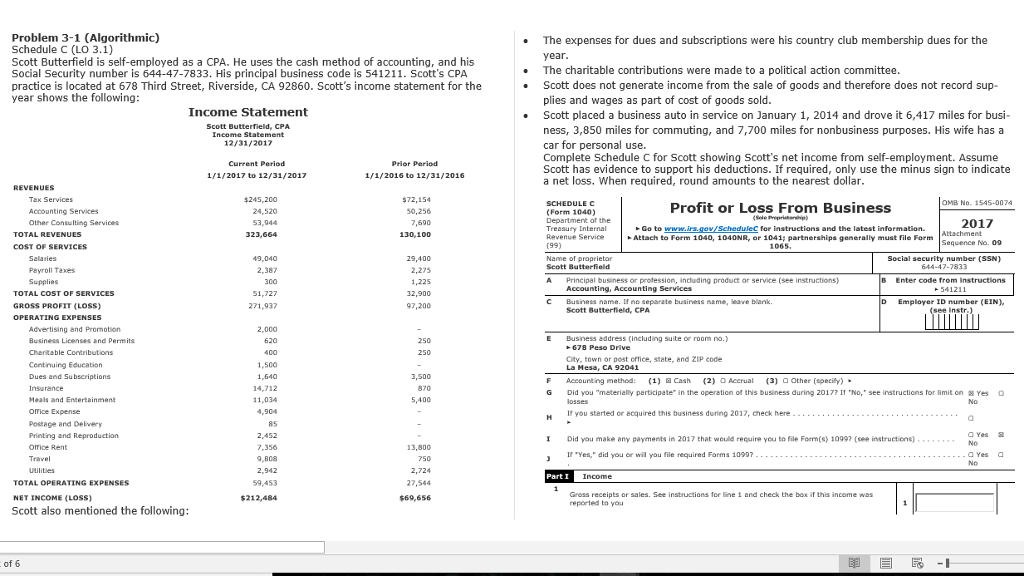

Question: Problem 3-1 (Algorithmic) Schedule C (LO 3.1) Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his Social Security

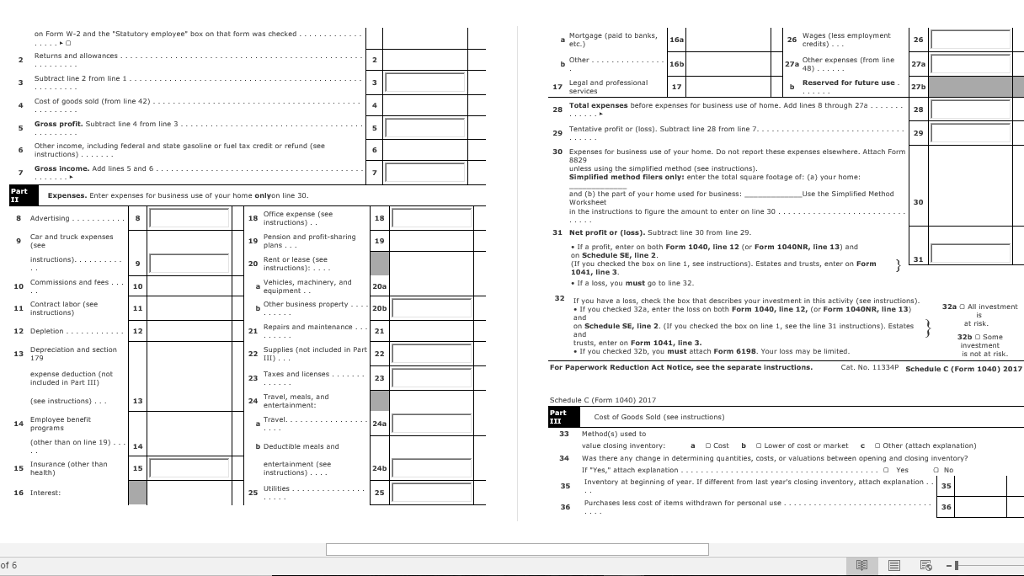

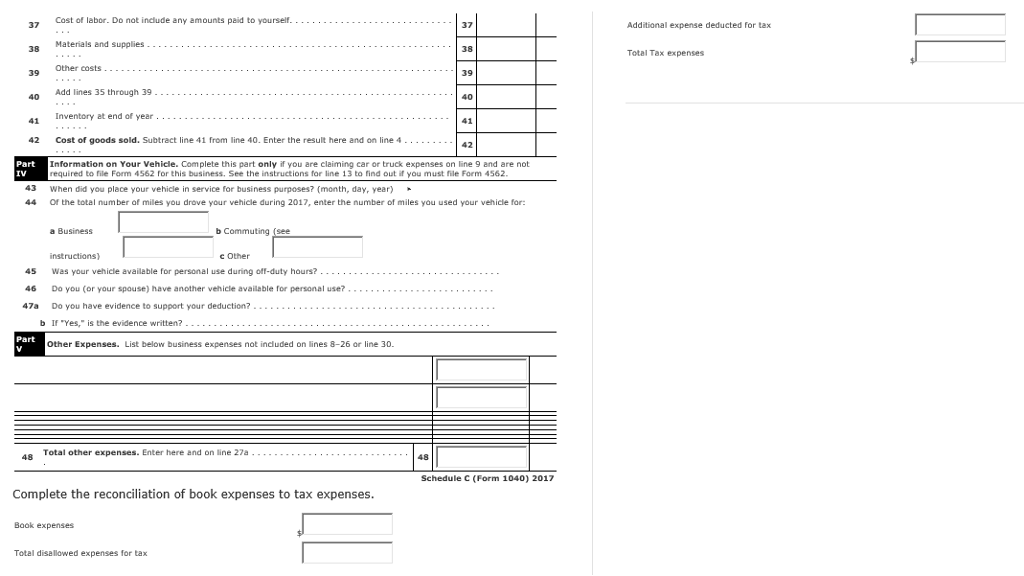

Problem 3-1 (Algorithmic) Schedule C (LO 3.1) Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his Social Security number is 644-47-7833. His principal business code is 541211. Scott's CPA practice is located at 678 Third Street, Riverside, CA 92860. Scott's income statement for the year shows the following The expenses for dues and subscriptions were his country club membership dues for the The charitable contributions were made to a political action committee Scott does not generate income from the sale of goods and therefore does not record sup- plies and wages as part of cost of goods sold Scott placed a business auto in service on January 1, 2014 and drove it 6,417 miles for busi ness, 3,850 miles for commuting, and 7,700 miles for nonbusiness purposes. His wife has a car for Complete Schedule C for Scott showing Scott's net income from self-employment. Assume Scott has evidence to support his deductions. If required, only use the minus sign to indicate a net loss. When required, round amounts to the nearest dollar . . Income Statement . 12/31/2017 1/1/2017 to 12/31/2017 1/1/2016 to 12/31/2016 $245,200 No. 1545-0074 SCHEDULE C (Form 1040) Profit or Loss From Business 53,944 2017 Revenue Service Attach to Form 1040, 1040NR, or 1041; Partnerships generally must file Form Sequence No. 0 COST OF SERVICES Payroll Taxes A Principal business or profession, including product or service (see instructions) Accounting, Accounting Services Enter code from Instructions TOTAL COST OF S C Business name. If no separate business name, leave blank Scott Butterfield, CPA Employer ID number (EIN), GROSS PROFIT (LOSS) E Business address (including suite or room no. Oty, town or post office, state, and ZIP code Continuing Education Dues and Su bscriptions F Accounting method: (1) Cash (2) Accrual (3) Other (speciy) G Did you "materially perticipate" in the operation of this business during 2017 I No, see instructions for limit con &Yes 14,712 If you started or ecquired this business during 2017, check here Postage and Delivery I Did you make any payments in 2017 that would require you to file Forrm(s) 1099 (see instructions) ofmice Rent !!"Yes," did you or wil you file required Forms 1000? TOTAL OPERATING EXPENSES NET INCOME (LOsS) Scott also mentioned the following: 59,453 Gress receipts or sales. See instructions for ine 1 and check the box if this income was 212,484 Problem 3-1 (Algorithmic) Schedule C (LO 3.1) Scott Butterfield is self-employed as a CPA. He uses the cash method of accounting, and his Social Security number is 644-47-7833. His principal business code is 541211. Scott's CPA practice is located at 678 Third Street, Riverside, CA 92860. Scott's income statement for the year shows the following The expenses for dues and subscriptions were his country club membership dues for the The charitable contributions were made to a political action committee Scott does not generate income from the sale of goods and therefore does not record sup- plies and wages as part of cost of goods sold Scott placed a business auto in service on January 1, 2014 and drove it 6,417 miles for busi ness, 3,850 miles for commuting, and 7,700 miles for nonbusiness purposes. His wife has a car for Complete Schedule C for Scott showing Scott's net income from self-employment. Assume Scott has evidence to support his deductions. If required, only use the minus sign to indicate a net loss. When required, round amounts to the nearest dollar . . Income Statement . 12/31/2017 1/1/2017 to 12/31/2017 1/1/2016 to 12/31/2016 $245,200 No. 1545-0074 SCHEDULE C (Form 1040) Profit or Loss From Business 53,944 2017 Revenue Service Attach to Form 1040, 1040NR, or 1041; Partnerships generally must file Form Sequence No. 0 COST OF SERVICES Payroll Taxes A Principal business or profession, including product or service (see instructions) Accounting, Accounting Services Enter code from Instructions TOTAL COST OF S C Business name. If no separate business name, leave blank Scott Butterfield, CPA Employer ID number (EIN), GROSS PROFIT (LOSS) E Business address (including suite or room no. Oty, town or post office, state, and ZIP code Continuing Education Dues and Su bscriptions F Accounting method: (1) Cash (2) Accrual (3) Other (speciy) G Did you "materially perticipate" in the operation of this business during 2017 I No, see instructions for limit con &Yes 14,712 If you started or ecquired this business during 2017, check here Postage and Delivery I Did you make any payments in 2017 that would require you to file Forrm(s) 1099 (see instructions) ofmice Rent !!"Yes," did you or wil you file required Forms 1000? TOTAL OPERATING EXPENSES NET INCOME (LOsS) Scott also mentioned the following: 59,453 Gress receipts or sales. See instructions for ine 1 and check the box if this income was 212,484

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts