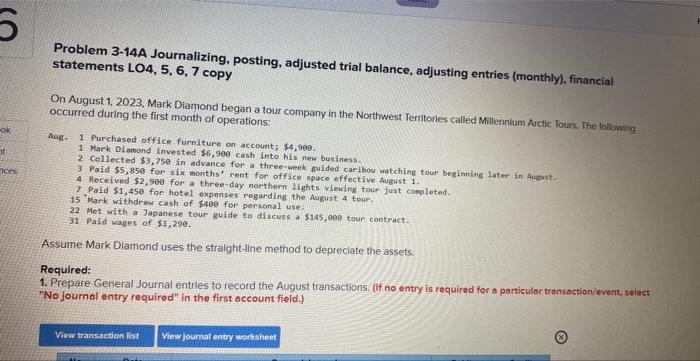

Question: Problem 3-14A Journalizing, posting, adjusted trial balance, adjusting entries (monthly), financial statements LO4,5,6,7 copy On August 1, 2023, Mark Diamond began a tour company in

Problem 3-14A Journalizing, posting, adjusted trial balance, adjusting entries (monthly), financial statements LO4,5,6,7 copy On August 1, 2023, Mark Diamond began a tour company in the Northwest Ferritories called Millennium Arctic Tours. The following occurred during the first month of operations: Aug. 1 Purchased office furniture on account; $4,900. 1 Mark Oi amond invested 86,900 cash into his nee business. 2 Collected $3,758 in advance for a three-iseek guided caribou watching tour beginning later in Ausust. 3. Paid $5,850 for six months' rent for office space effective August 1. 4. Received $2,900 for a three-day northern lights viewing tour just coegleted. 15 Mark withdren cash of $40e for persanal 1 use. 22 Met with a Japanese tour guide to discuss a $145,000 tour contract. 31 Pasd wages of $1,290. Assume Mark Diamond uses the straight-line method to depreciate the assets. Roquired: 1. Prepare General Journal entries to record the August transactions, (If no entry is required for a particular trensoction/event, seiect "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts