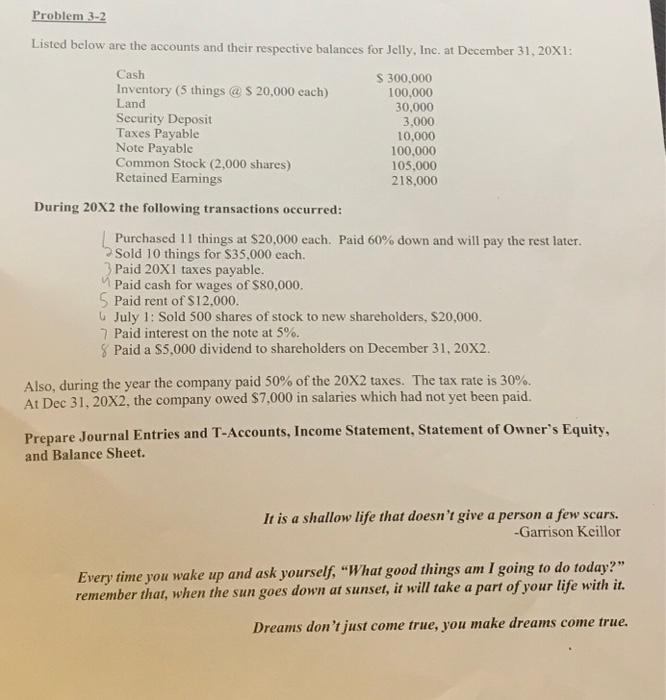

Question: Problem 3-2 Listed below are the accounts and their respective balances for Jelly, Inc. at December 31, 20X1: $ 300,000 100,000 30,000 3,000 10,000 Cash

Listed below are the accounts and their respective balances for Jelly, Ine. at December 31, 20X1: During 20X2 the following transactions occurred: Purchased 11 things at $20,000 each. Paid 60% down and will pay the rest later. Sold 10 things for $35,000 each. 3 Paid 20X1 taxes payable. Paid cash for wages of $80,000. 5 Paid rent of $12,000. 4 July 1: Sold 500 shares of stock to new shareholders, $20,000. 7 Paid interest on the note at 5%. 8 Paid a $5,000 dividend to shareholders on December 31,20X2. Also, during the year the company paid 50% of the 202 taxes. The tax rate is 30%. At Dec 31, 20X2, the company owed $7,000 in salaries which had not yet been paid. Prepare Journal Entries and T-Accounts, Income Statement, Statement of Owner's Equity, and Balance Sheet. It is a shallow life that doesn't give a person a few scars. -Garrison Keillor Every time you wake up and ask yourself, "What good things am I going to do today?" remember that, when the sun goes down at sunset, it will take a part of your life with it. Dreams don't just come true, you make dreams come true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts